ARK Invest CEO Cathie Wood called out the US Federal Reserve on its basis for deciding to hike interest rates in an attempt to control the surging inflation.

In an open letter to the Fed, Wood tried to debunk the the unanimity of the decision to increase the borrowing rates by offering alternative data that argue most commodity prices have already peaked.

“Out of concern that the Fed is making a policy error that will cause deflation, we offered some data for our ‘data-driven’ Fed to consider as it prepares for its next decision on November 2,” Wood started.

The Fed after reading Cathie Wood’s open letter#Fed #CathieWood $ARKK pic.twitter.com/fQAyJhcEEf

— The Dive Feed (@TheDeepDiveFeed) October 11, 2022

In the letter, Wood tries to school the fiscal policy maker by differentiating the upstream price deflation from downstream inflation–which she argues to be a lagging indicator on which the Fed bases its interest hike decisions.

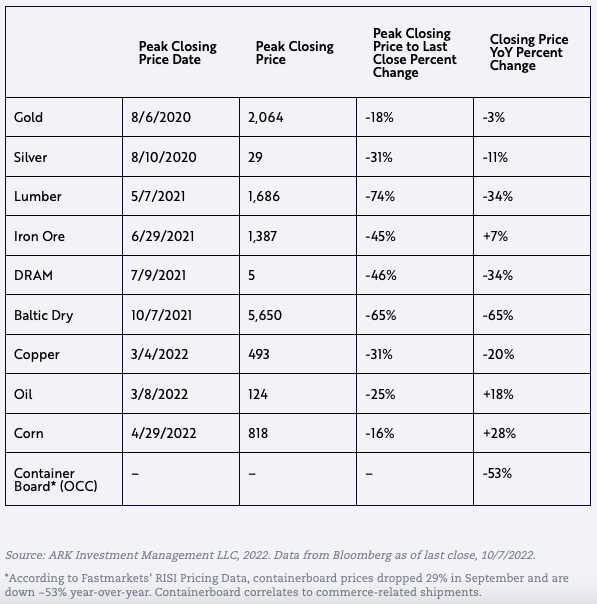

The investment manager then argued that the Fed should look instead at commodity prices as “leading indicators, upstream in the stages of processing.” In her data, she showed that commodity prices have peaked and, except for food and energy, are falling on a year-over-year basis.

“Without question, food and energy prices are important, but we do not believe that the Fed should be fighting and exacerbating the global pain associated with a supply shock to agriculture and energy commodities caused by Russia’s invasion of Ukraine,” she added.

Then, Wood further convoluted the discussion by citing Walmart, Target, and Nike’s high inventory problems. Seemingly arguing that abundance of supply would lead to a downtrend for retail prices, the ARK Invest chief cited used car prices as an example as these have fallen down, “13.5% year to date and now are down 0.1% year-over-year.”

“Facing inventory losses, used car dealers are likely to disgorge more inventories, which could push price inflation deeply into negative territory,” she warned.

Given the accelerated consumer preference shift toward electric vehicles, used car prices and the residual value of all gas powered autos are likely to plummet, causing serious losses in the $1 trillion auto debt market. https://t.co/cyLLGl1gWI

— Cathie Wood (@CathieDWood) October 10, 2022

Wood then moved to highlight the piece of her letter: the unanimity of Fed’s decision to raise interest rates.

“The Fed seems focused on two variables that, in our view, are lagging indicators––downstream inflation and employment––both of which have been sending conflicting signals and should be calling into question the Fed’s unanimous call for higher interest rates,” argued Wood.

Consumer prices jumped 0.1% between July and August, cementing in an eye-watering 8.3% increase compared to last year.

But Wood tried to support her argument of “conflicting signals” by highlighting that while headline inflation increased, “home prices as measured by the Federal Housing Finance Agency (FHFA) fell 0.6%.”

On the employment front, while job openings as reported by indices have fallen down and job separations have soared, “initial claims for unemployment insurance declined and nonfarm payroll employment increased.”

“Could it be that the unprecedented 13-fold increase in interest rates during the last six months––likely 16-fold come November 2––has shocked not just the US but the world and raised the risks of a deflationary bust?” ended Wood.

But many have taken Wood’s view on macroeconomics with a grain of salt.

Cathie Wood is down so bad she’s demanding to speak to the manager of the stock market. pic.twitter.com/UJeuV4vpOI

— Chris Bakke (@ChrisJBakke) October 10, 2022

The Fed after reading Cathie Wood’s open letter pic.twitter.com/FeqlEWGobT

— Not Jerome Powell (@alifarhat79) October 10, 2022

To the Moon …#ARK #CathieWood pic.twitter.com/ICbm3CQT29

— Wall Street Silver (@WallStreetSilv) October 11, 2022

US Fed Chair Jerome Powell recently said the Fed will not let off on its hawkish monetary policy regardless of the economic pain caused by rising interest rates.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.