The United States Federal Trade Commission (FTC) has imposed a hefty $4.7-billion fine on bankrupt crypto lender Celsius Network, accusing the company and its executives of deceptive practices. The judgement, however, will be suspended temporarily to enable Celsius to return its remaining assets to consumers in bankruptcy proceedings.

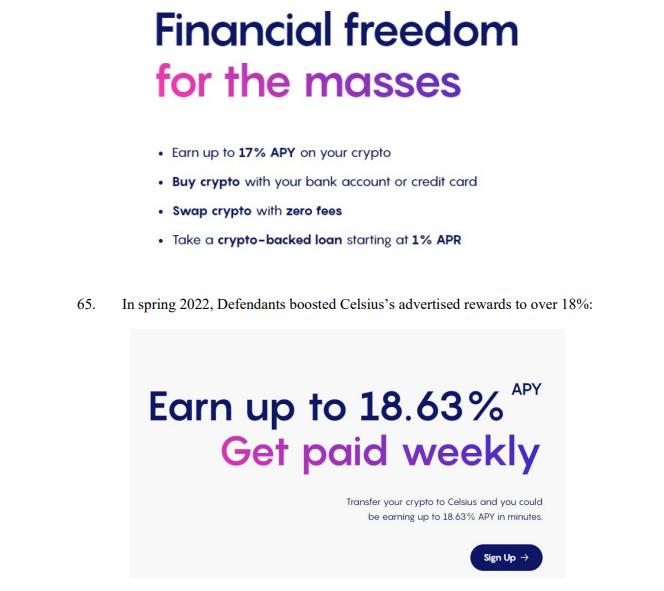

Celsius Network, based in New Jersey, marketed various cryptocurrency products and services, including interest-bearing accounts, personal loans secured by cryptocurrency deposits, and a cryptocurrency exchange. The FTC alleged that co-founders Alex Mashinsky, Shlomi Leon, and Hanoch Goldstein misled consumers by promoting the platform as a “safe place” for their cryptocurrency deposits while misappropriating over $4 billion in consumer assets.

“Celsius touted a new business model but engaged in an old-fashioned swindle,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “Today’s action banning Celsius from handling people’s money and holding its executives accountable should make clear that emerging technologies are not above the law.”

In connection with Celsius's $4.7B settlement announced today, the FTC issued this warning to crypto companies:

— Rob Freund (@RobertFreundLaw) July 13, 2023

"Disabuse yourself immediately of an 'anything goes' attitude in the marketing of crypto." pic.twitter.com/xfCUC0ZCqW

The co-founders have not agreed to a settlement with the FTC, and the case against them will proceed to federal court.

The FTC also accused Celsius of making $1.2 billion in unsecured loans, falsely claiming to have a $750-million user insurance policy, and lacking a system to track its assets and liabilities until late 2021. Executives allegedly lied about the company’s financial health even during the cryptocurrency bear market, leading to consumers losing access to their funds.

The Securities and Exchange Commission and the Commodity Futures Trading Commission have also filed lawsuits against Celsius, and Mashinsky has been indicted on seven fraud-related charges by the U.S. Department of Justice. Celsius previously filed for bankruptcy in July 2022.

The FTC’s settlement with Celsius and its affiliates permanently prohibits them from handling consumers’ assets and bans them from offering, marketing, or promoting any asset-related product or service.

Celsius released a statement expressing satisfaction with the resolutions reached with government agencies, emphasizing that the settlements would not affect their bankruptcy plan or the return of funds to customers. The company also pledged to cooperate with regulators and government entities.

And We the Users, who spent their hard earned money on your extreme risk taking lies, are pleased to see Alex Mashinsky charged with multiple crimes https://t.co/QCnjAGPFzK

— Digital Asset Updates (@DigitalAssetUpd) July 13, 2023

The crypto community’s response to Celsius’ statement was largely negative, with many criticizing the company’s lack of accountability and demanding apologies for mistreating customers. Some expressed frustration over legal jargon and urged the company to distribute remaining funds and move on.

In addition to the FTC’s actions, the SEC has filed a lawsuit against Celsius and Mashinsky, accusing the former CEO of making false promises regarding the company’s “Earn Interest Program.” Mashinsky has been charged with multiple crimes and was arrested on the same day as the indictment. He pleaded not guilty and was released on a $40 million bond, with travel and account restrictions imposed.

Information for this briefing was found via Coin Telegraph and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.