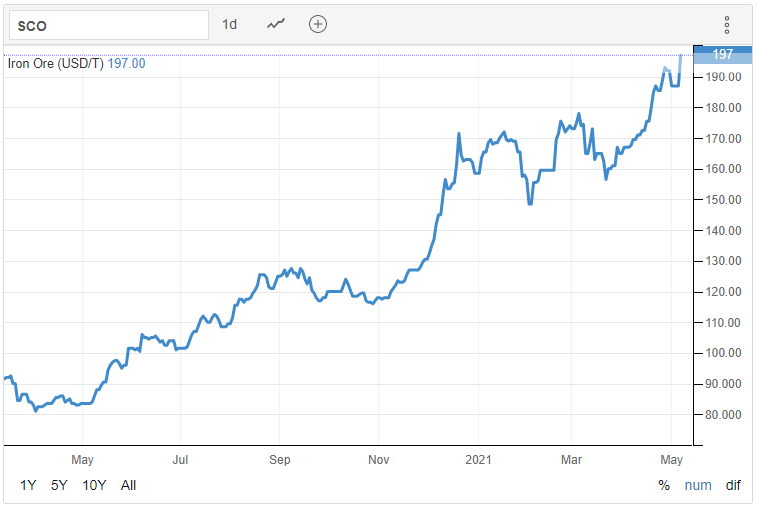

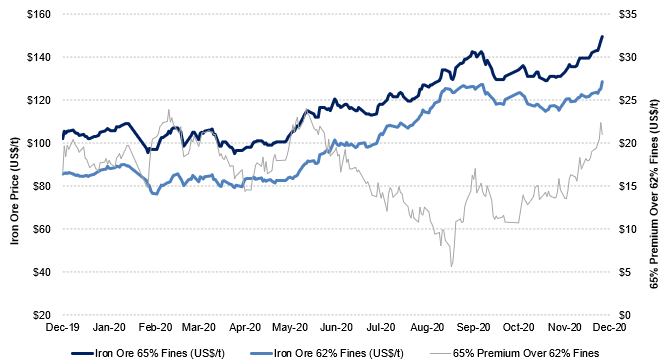

Iron ore prices continued their sharp rebound over the last twelve months, essentially reaching all-time highs last seen in early 2008 and early 2011. Growing global steel demand and an increasing environmental focus in China and elsewhere have been the main factors in the price move, particularly for higher-grade iron ore.

Specifically, the introduction of high-grade iron ore (65%+ Fe content) into the steelmaking process reduces the quantities of both iron ore feedstock and coke required to produce steel and increases blast furnace productivity, which in turn lowers the overall cost to convert the ore to steel. Carbon dioxide emissions levels are likewise reduced. In recent years, Chinese steel producers have increasingly utilized high quality iron ore to produce more steel (but less carbon-intensive steel) at higher profit margins and in a more efficient manner.

Emissions considerations — and the economic impact of emissions — are almost certain to grow in importance as effluents increase on almost a daily basis. Competitive pressures dictate that the average blast furnace size will continue to increase. More stringent environmental regulations will follow, which in turn will increase demand for higher-grade raw material that Champion Iron Limited (TSX: CIA) produces. High-grade sales currently comprise just over one-third of all iron ore sales.

The graph below shows the prices of 65% iron content ore, baseline 62% iron content ore, and the difference between the two, or the premium that 65% iron-content ore commands over the baseline variety. The premium is currently about US$24 per tonne, or about US$8 per tonne per percentage point. This implies that Champion’s primary asset, Bloom Lake, sees its 66% iron-content ore currently command an all-in price of around US$210 per tonne.

Champion Iron’s Bloom Lake Project

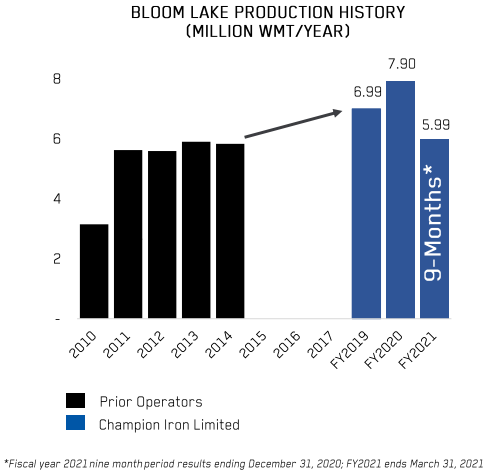

Champion’s flagship project is Bloom Lake, which is located 13 kilometers north of Fermont, Quebec. Champion acquired Bloom Lake from Cliffs Natural Resources in 2016 for only $10.5 million. It has Phase I mineral resources of 411.7 million tonnes and a theoretical annual production capacity of 7.4 million tonnes of 66% Fe iron ore concentrate over an estimated 20-year remaining mine life. (That nameplate capacity was exceeded in FY20 and seems likely to be exceeded again in FY21.)

Financials Have Improved Dramatically Over the Last Twelve Months

Rising iron ore prices have caused Champion’s key financial parameters to improve noticeably over the last twelve months. For example, the company’s EBITDA in the quarter ended December 31, 2020 totaled $211.9 million, up from $61.1 million in the quarter ended March 31, 2020. Similarly, Champion had $263 million of net cash on December 31, 2020 versus $21 million as of March 31, 2020.

Champion trades at an enterprise value (EV)-to-trailing 12 months EBITDA of about 5x ($2.94 billion divided by $598.5 million).

| (in thousands of Canadian $, except for shares outstanding) | Trailing 12 Months | 3Q FY21 | 2Q FY21 | 1Q FY21 | 4Q FY20 |

| Revenue | $1,060.8 | $329.5 | $311.0 | $244.6 | $175.7 |

| Operating Income | $563.7 | $203.3 | $189.5 | $118.8 | $52.1 |

| EBITDA | $598.5 | $211.9 | $197.8 | $127.7 | $61.1 |

| Adjusted EPS – Basic | $0.71 | $0.26 | $0.24 | $0.17 | $0.04 |

| Cash – Period End | $507 | $426 | $348 | $299 | |

| Debt – Period End | $244 | $261 | $267 | $278 | |

| Shares Outstanding (Millions) | 489.3 | 473.1 | 472.8 | 467.7 |

If global steel demand were to slow noticeably due perhaps to decisions by governments of the world’s leading economies to cease their accommodative monetary policies, the price of iron ore would be negatively affected. In turn, the shares of leading iron producers such as Champion would likely suffer.

Iron ore has been the highest price-appreciating mainstream commodity over the past year, as governments globally spend billions on major infrastructure projects to stimulate their economies as part of COVID-19 recovery. Champion is a well-positioned, low-cost producer of high-grade iron ore. It currently generates substantial free cash flow and trades at an EV-to-EBITDA ratio of only about 5x.

Champion Iron Limited last traded at $6.55 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.