On December 19, Gabriel Boric, a 35-year-old leftist candidate and former student protest leader, decisively defeated (56% to 44%) a far-right rival to become the next president of Chile. Some of Mr. Boric’s key positions during the campaign include narrowing the wide income gap between Chile’s most and least fortunate, reforming the country’s pension and healthcare systems, and, most importantly for this article, championing green investment. Specifically, the new leader promises to block a controversial US$2.5 billion copper, iron and gold mining project.

The Domingo project, which is 310 miles north of Santiago and is being developed by Andes Iron, was approved by a regional environmental commission in August 2021 after years of wrangling in Chile’s court system. Mr. Boric has said that “Destroying the world is destroying ourselves. We do not want more ‘sacrifice zones,’ we do not want projects that destroy our country, that destroy communities.”

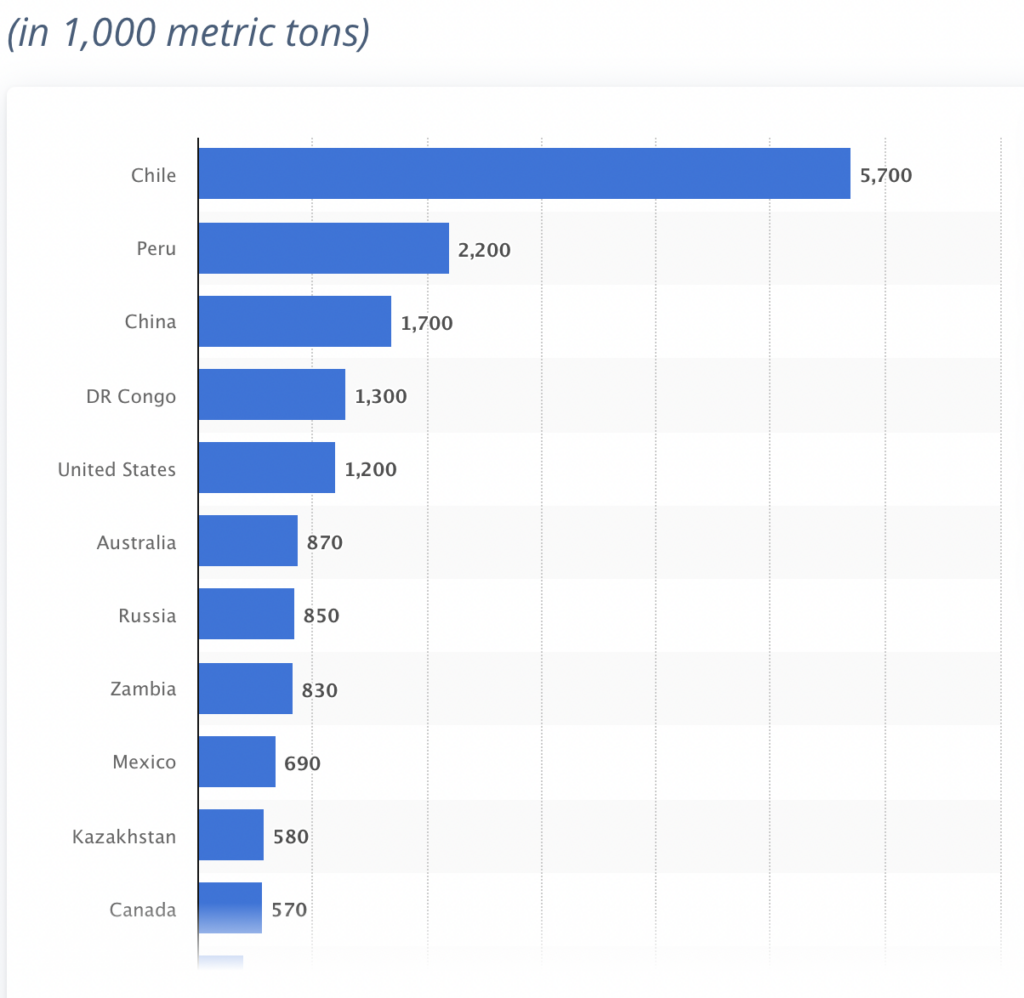

Mr. Boric’s views should be interpreted as a negative for copper mining in Chile, a country which produced 28.5% of the world’s copper in 2020. Copper and lithium mining in aggregate comprise about 10% of Chile’s GDP, and more than half of its exports.

It follows that the Chilean election outcome could suggest that speculative investors may consider committing some capital to copper project developers which own promising properties outside of Chile. After all, global copper demand is expected to grow significantly as the world continues to recover from the COVID-19 pandemic.

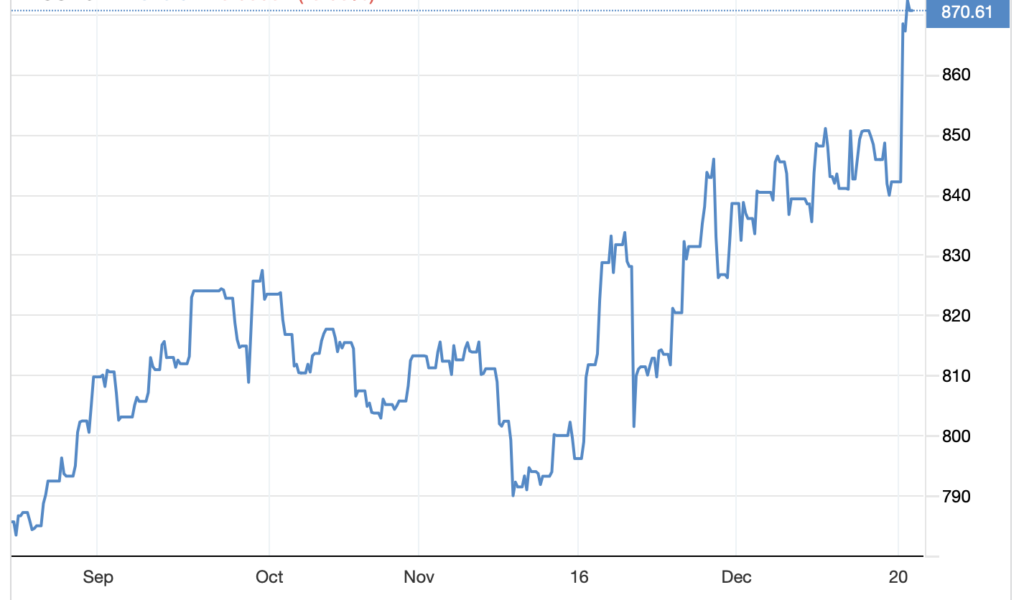

A graph of the Chilean peso seems to confirm potential concerns about the country’s economy and its main mining engine in light of Mr. Boric’s victory. The currency declined about 5% against the U.S. dollar on December 20 alone, and has lost around 10% of its value in the last month as the foreign exchange market anticipated the election outcome.

Chile’s new leader’s leftist leanings represents a threat to the country’s copper mining industry. Speculative investors may consider allocating capital to underperforming non-Chilean copper developers, rather than those that are now exposed to a high level of risk.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.