Lets not forget about China Evergrande just yet!

On Monday, Reuters reported that trading of Evergrande shares and onshore bonds issued by its other unit, Hengda Real Estate Group, were suspended awaiting “inside information statements” from the embattled property developer. The company filings failed to provide additional details, but shares of Evergrande Property Services Group and China Evergrande New Energy Vehicle Group were also halted today, according to exchange filings.

Evergrande, the world’s most indebted property development company, has been trying to dig itself out of a $300 billion liabilities hole, after nearly facing default on numerous occasions. Back in January, the company announced it will unveil an initial restructuring proposal by the second half of 2022, meanwhile, over the weekend, its onshore received approval to postpone interest payments on its denominated bond.

Although Evergrande has thus far been able to avoid a technical default on its onshore bonds, it has missed coupon payments on several offshore ones. But, despite the dust settling on the real estate developer’s debt crisis— which we covered here on the Deep Dive on several occasions, it appears China’s entire real estate market still has a long way to go before its out of the woods.

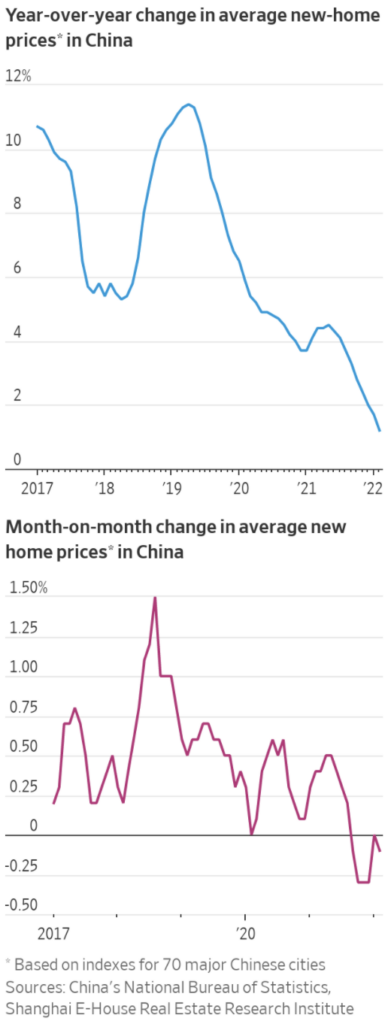

As the Wall Street Journal points out, Chinese property developers are having a difficult time selling properties to consumers, despite February’s 1.2% increase in overall new-home prices. The divergence— which the Chinese government tastefully masks in the composition of statistical data— shows that heavily-indebted developers are desperately selling apartments at substantially lower prices, and even enticing potential homebuyers with major discounts and incentives.

Since the summer of 2021, most Chinese residential property developers have suffered significant declines in contracted sales, as well as a drop in average selling prices. “The market has yet to show a clear recovery,” said real-estate-industry data provider CRIC vice-research director Lin Bo. “The supply, demand and prices are going down,” he explained, referring to homes.

Since the Evergrande crisis, the Chinese government imposed stringent regulations on borrowing by property developers, while offshore and onshore investors liquidated their dollar-denominated bonds and subsequently sent yields soaring to over 30%, making it even more difficult for companies to raise cash. This prompted many liquidity-strapped developers to quickly sell new apartments at low prices in a bid to avert defaults.

Information for this briefing was found via Reuters and the WSJ. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.