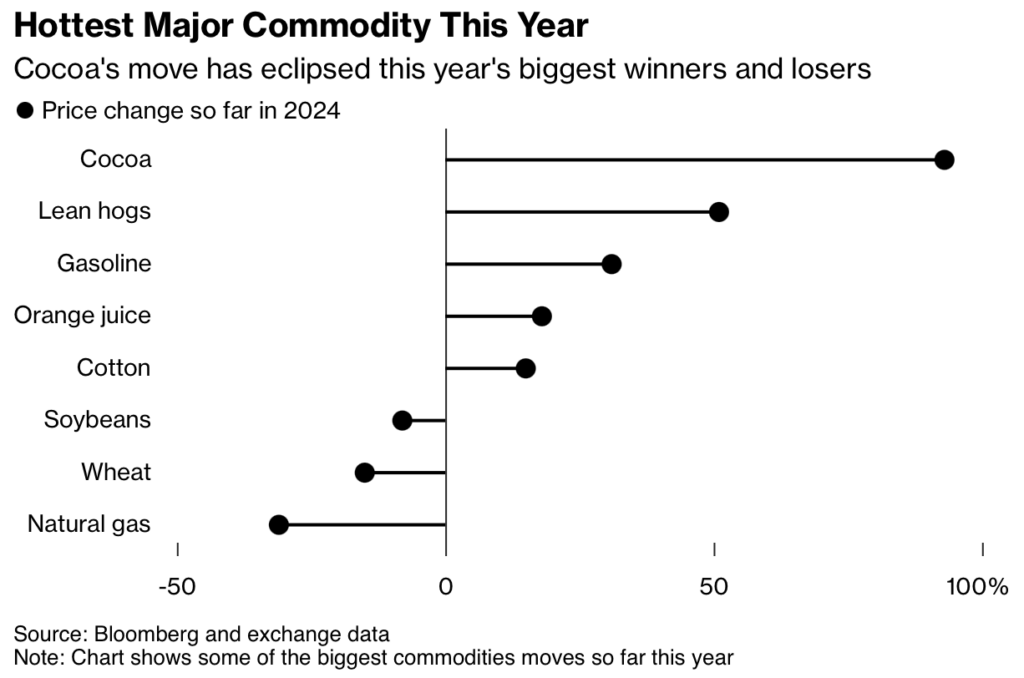

Cocoa futures have once again surged upwards, surpassing $9,000 per metric ton, marking a record-breaking high.

At the outset of 2024, cocoa was trading at levels below $4,200 per ton. Prices have also escalated by over 10% within just the span of a single week alone.

The impetus behind this historic rise traces back to a combination of supply and demand disruptions. Severe El Niño-induced dry weather conditions, alongside reported wildfires and an outbreak of the cacao swollen shoot virus, have significantly curtailed cocoa supply. Concurrently, demand has remained robust in nations such as the U.S., facilitating companies like Hershey’s and Mondelez to pass on the burden of escalating prices to consumers.

Cocoa is the new crypto pic.twitter.com/bdo1lLYXpe

— David Ingles (@DavidInglesTV) March 23, 2024

Cocoa Supply

The prices are affected by the persistent concerns surrounding the tight cocoa supplies originating from West Africa. Traders noted a sense of unease in the market, triggered by recent reports suggesting disruptions in cocoa processing activities in Ivory Coast and Ghana, as some plants either ceased or scaled back operations due to financial constraints in bean procurement.

The Ivory Coast, a major cocoa-producing region, is presently grappling with hotter-than-usual temperatures, casting doubts on the forthcoming rainy season, which typically spans from April to October.

The most recent data reveals a substantial decline in cocoa shipments from Ivorian farmers to ports, with figures showing a 29% drop compared to the corresponding period last year, totaling 1.22 million metric tons (MMT) from October 1 to March 10. Additionally, the Ivorian cocoa regulatory body anticipates a significant decrease in the upcoming mid-crop, which officially commences in April. Projections indicate a 33% decline to 400,000 metric tons from last year’s 600,000 metric tons.

While initially fueled by West African supply issues, the surge in cocoa prices is now propelled by momentum, according to Jeff Kilburg, CEO of KKM Financial.

“That additional speculative component of cocoa futures has the ability to exaggerate moves. And I think that exaggeration is currently being priced in because I believe the supply gap or supply disruption was priced in probably 25% to 30% ago,” he said in a CNBC interview.

In Kilburg’s assessment, there appears to be no immediate respite in sight for the upward trajectory of cocoa prices. In fact, he suggests that prices could surge by another 50% before the rally subsides, underscoring the unpredictability inherent in commodity markets.

Cocoa Demand

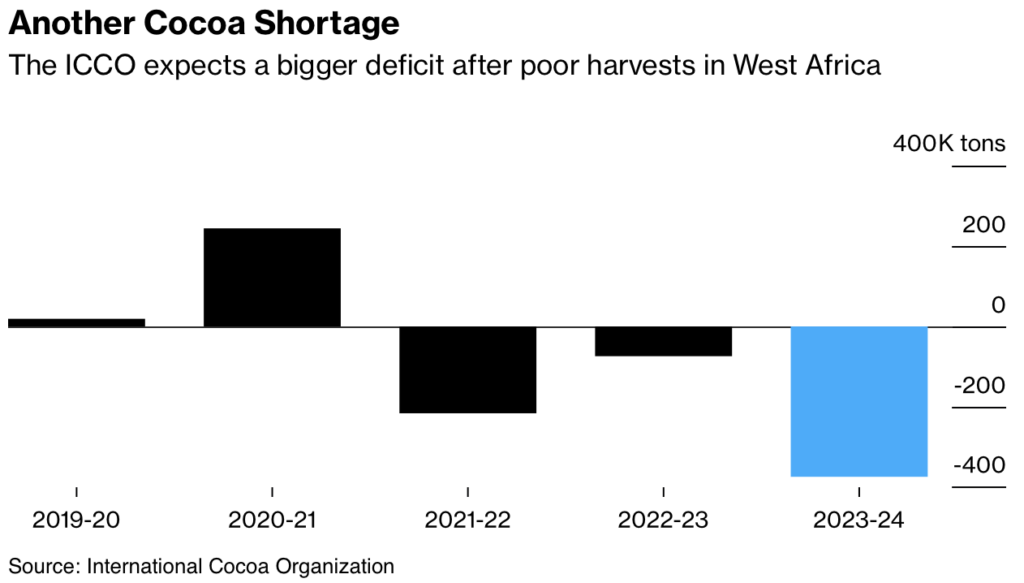

Simultaneously, the International Cocoa Organization (ICCO) released forecasts on February 29, highlighting a sharp widening of the global cocoa deficit for the 2023/24 season. The deficit is expected to expand drastically to 374,000 metric tons, a significant increase from the 74,000 metric tons recorded in the previous season (2022/23).

Rising cocoa prices, as depicted in these charts, are compelling confectionery manufacturers to innovate by introducing new products containing reduced amounts of the costly ingredient, or in some cases, entirely devoid of it. Thus far, they have transferred the burden of increased costs onto consumers.

Major chocolate producer Barry Callebaut has issued a cautionary statement, predicting prolonged acute cocoa shortages extending into the upcoming season.

The impact of this scarcity is most keenly felt in Europe, the world’s largest consumer of chocolate. The region faces additional challenges with impending EU regulations aimed at prohibiting the sale of products contributing to deforestation.

Globally, the cocoa industry is confronted with a third consecutive season of deficit, underscoring the severity of the supply challenges facing the sector.

Information for this story was found via Bloomberg, CNBC, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.