On Friday, Cannacord Genuity downgraded Cineplex (TSX: CGX) from a Hold to a Sell rating and lowered its 12-month price target to C$7 from C$8. Canaccord’s analyst Aravinda Galappatthige headlined the downgrading note with “estimates revised down; covenant needs to be renegotiated; downgrading to SELL.”

In the first significant point of this analyst note, Galappatthige says that the critical question is what a renegotiation with the banks would look like. She comments, “on one hand the banks already extracted a significant degree of protection for themselves last time around, including new financing (~$300M in converts), a $100M repayment, decrease in maturity, etc., is there really more they can ask for?” and says that banks need to look at the current situation that Cineplex is in with a longer-term lense, “at least one that goes into F2022.”

She says that the unknown cost of a revised bank agreement has to be considered, and the underlying value could deteriorate quickly if a poor agreement were reached. Galappatthige adds that, “it is clear to us that the renewed covenants with the banks can no longer be met,” as there has been an uptick in COVID cases in Canada alongside Quebec reinstating certain pandemic restrictions which include closing theatres, reducing potential revenues significantly.

To weather the storm, Cineplex has been benefitting from CEWS and is continuing to renegotiate leases to help with their cost management. Galappatthige says that selling the head office location or the sale of CDM Cineplex’s signage business could be a potential option to raise cash.

Finally, the justification for the downgrade to the sell rating is predicated on waiting on the outcome of likely credit amendments. The analyst also noted that its debenture has since fallen below par for the first time this week which is said to reflect a rising risk profile.

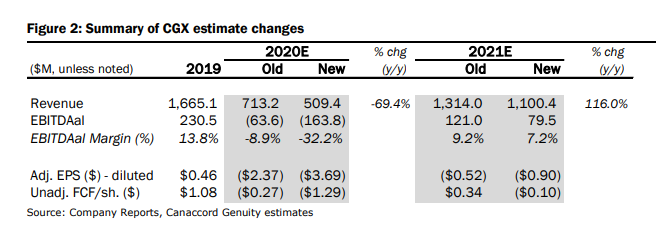

Below you can see the forecast changes Canaccord had made to incorporate the latest restrictions that have gone up.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.