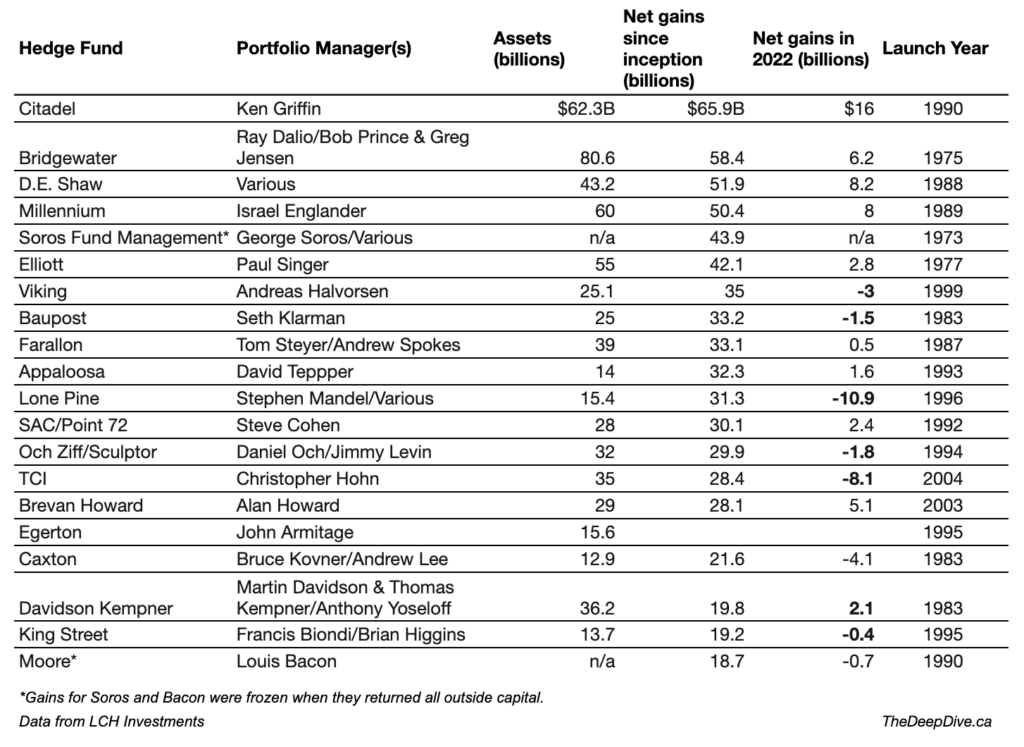

Ken Griffin’s Citadel is the top hedge fund of 2022 with a record profit of $16 billion for clients last year, according to LCH Investments’ annual ranking of the world’s top 20 hedge fund managers.

Citadel’s 2022 gain marks an all-time record for a hedge fund firm, and it outranks John Paulson’s record of $15 billion when he bet against subprime mortgages in 2007 — the so-called “greatest trade ever.”

The celebration mostly stops at that. The profit the top 20 firms, which are ranked by overall gains since inception, earned in 2022 only sums up to $22.4 billion after fees, according to estimates by LCH, the slimmest on record since 2016. In comparison, this figure was $65.4 billion in 2021, $63.5 billion in 2020, and $59.3 billion in 2019.

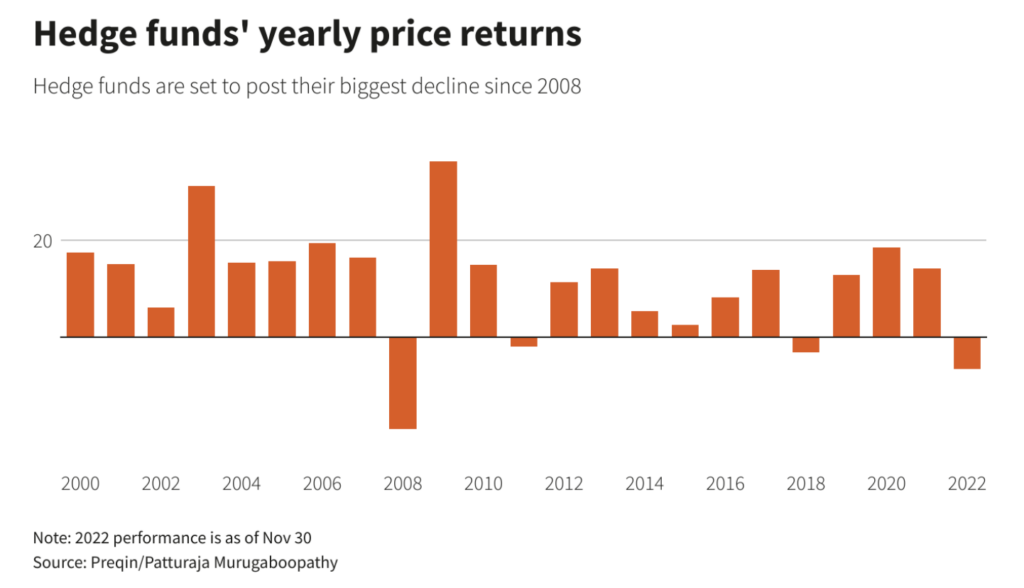

LCH data estimates an overall loss of $208 billion for hedge funds last year. And estimates a 3.4% return for the top firms, with the rest of the firms seeing losses of 8.2%.

Data from Reuters through November 30 found that 2022 was the worst year for hedge fund returns since 2008.

“The largest gains were once again made by the large multistrategy hedge funds like Citadel, DE Shaw and Millennium,” LCH Chairman Rick Sopher said in a news release. “The strong gains they have generated in recent years reflect their increasing dominance in strategies which do not depend on rising asset prices, and their substantial size.”

Research firm PivotalPath, via Bloomberg, found that over the global market turmoil that marked most of 2022, multistrategy funds gained 1.9%, while funds that bet on commodities and currencies using global macro-focused strategies led with a 12.2% gain. Equity-focused funds were not surprisingly the biggest losers with -13.4%.

Information for this story was found via LCH Investments, Bloomberg, Reuters, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.