On November 15th, CloudMD Software & Services (TSXV: DOC) announced that they would be acquiring MindBeacon Holdings (TSX: MBCN) for $116 million with 1 share of MindBeacon being exchanged for $1.22 of cash and 2.285 common shares of CloudMD. This equals a 49% premium to the 7-day volume-weighted average price.

The company expects to have immediate cost synergies of over $2 million. The company says that the proforma company is expected to be one of North America’s leading fully integrated offering companies.

CloudMD currently has 6 analysts covering the stock with an average 12-month price target of C$3.88, or a 178% upside to the current stock price. Out of the 6 analysts, 2 have strong buy ratings while the other 4 have buy ratings. The street high comes from Stephens Inc with a C$5 price target while the lowest sits at C$3.

In Canaccord’s note, they reiterate their speculative buy rating but lower their 12-month price target to C$3.00 from C$3.50 after refreshing their models, commenting, “The acquisition drives significant scale in mental health capabilities to combine with CloudMD’s existing mental health assets and its broader integrated health services offering.”

Canaccord says that there will be immediate overhead synergies of $2 million through the removal of public company costs and duplicate business branches. Additionally, CloudMD said there is potential to have long-term cost synergies through the combined therapist networks to optimize the admin costs. While the top-line synergies are seen by integrating MindBeacon’s iCBT offerings into CloudMD’s broader integrated health services.

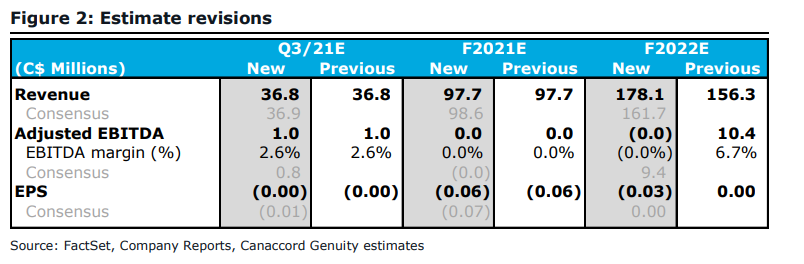

Below you can see Canaccord’s updated third quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.