On March 9th, CloudMD Software & Services (TSXV: DOC) announced that their C$55 million bought deal financing closed, with underwriters taking an additional 1.9 million shares equal to C$5.1 million.

CloudMD currently has five analysts covering the company with a weighted 12-month price target of C$3.82. This is down from last month, which was C$3.91. One analyst has a strong buy rating, while the other four have buy ratings on the name.

The street high comes from Laurentian Bank with a C$4.25 price target, and the lowest target comes from Canaccord Genuity with a C$3.50 price target. Laurentian Bank raised their price target from C$4 to C$4.25 while Canaccord downgraded the name from C$3.75 to C$3.50 after they both were a part of the underwriting, with Canaccord Genuity actually leading the underwriting.

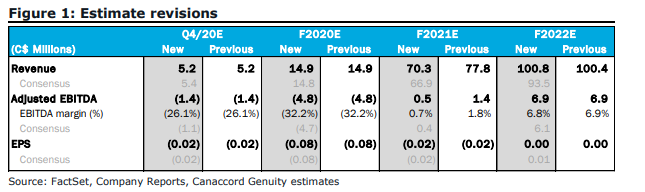

Doug Taylor, Canaccord’s analyst, reiterated his speculative buy rating and headlines, “Updating model to reflect reloaded balance sheet and timing of M&A closing.” The main reason for the downgrade was due to the dilution via the financing, while they did very slightly change their full-year 2021 and 2022 revenue estimate.

Taylor believes that after the financing, the company now has on a pro-forma basis C$60 million in cash and “is well-capitalized to pursue additional M&A targets.” The company also announced that they signed a definitive agreement with IDYA4. The company did U$4.4 million in revenue with a 31% EBITDA margin in 2020. The deal is expected to close by the end of March, while Canaccord has moved back the closing date of VisionPros to late in the second quarter.

Taylor touches on the March 2nd partnership with Medavie Blue Cross. He writes, “the announcement highlights CloudMD’s increased focus on digital corporate and insurer offerings in addition to primary health services. We understand that, in recent months, CloudMD has seen success in cross-selling its broader footprint of enterprise-focused solutions to drive organic growth post-acquisition.”

Below you can see Canaccord’s slight estimate changes for the years 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.