As has been widely reported, Coinbase (NASDAQ: COIN) has recently been in communication with the SEC related to a Wells Notice that the firm previously received. Following CEO Brian Armstrong taking to Twitter Tuesday night in relation to the notice, the firm filed an 8-K with the SEC denoting the announcement.

It turns out that the initial Wells Notice was received by the firm on September 1, 2021, as per the filing by the company. While the drama that has unfolded between Armstrong, Coinbase, and the SEC on Twitter has been hilarious, perhaps what’s even more interesting than the legal notice itself, is the apparent actions by insiders following the receipt of the notice.

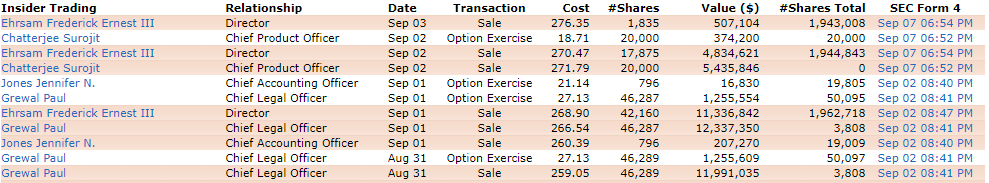

Notably, a number of insiders have conducted share sale transactions between September 1, and the filing of the 8-K on Tuesday night. In total, four members of the executive management team conducted transactions in this time frame, with three of the individuals having those transactions take place on September 1. Naturally, its unclear if the Notice had been viewed at the time of these transactions, but regardless the actions are questionable.

Among those whom sold shares on September 1, are Paul Grewal, Chief Legal Officer, Jennifer Jones, Chief Accounting Officer, and Frederick Ernest III Ehrsam, a director. Surojit Chatterjee, Chief Product Officer, sold shares the following day, as did Ehrsam. Ehrsam also conducted a third sale of shares during this time period, which occurred on September 3.

The share sales by the executives break down as follows:

- Frederick Ernest III Ehrsam: 61,870 shares in aggregate for gross proceeds of $16,678,567

- Sept 1: 42,160 shares for proceeds of $11,336,842

- Sept 2: 17,875 shares for proceeds of $4,834,621

- Sept 3: 1,835 shares for proceeds of $507,104

- Paul Grewal: 46,287 shares for proceeds of $12,337,350 on Sept 1

- Surojit Chatterjee: 20,000 shares for proceeds of $5,435,846

- Jennifer Jones: 796 shares for proceeds of $207,270

It should be stated here that all of the listed transactions were reportedly conducted as per a Rule 10b5-1 trading plan. Only Chatterjee had not conducted a share sale transactions previously out of the four executives, with Grewal having conducted his first transactions on August 31, consisting of 46,289 shares sold for proceeds of $11,991,035.

In total, between September 1 and the Form 8-K filed on September 7, company insiders sold $34,659,033 worth of shares in aggregate.

Coinbase last traded at $258.20 on the Nasdaq.

Information for this briefing was found via Edgar, Coinbase and Finviz. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.