Coinbase Global, Inc. (NASDAQ: COIN) investors have been little fazed by the SEC’s decision to send the company a dreaded Wells Notice. This action, which means the SEC enforcement staff intends to recommend to the SEC commissioners they should charge the company with U.S. securities law violations, related to assets listed and traded on Coinbase’s platform and Coinbase’s staking and wallet services.

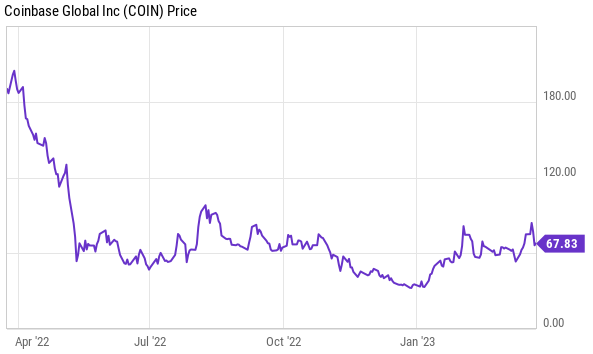

To be sure, Coinbase stock has declined 12% since the company disclosed the SEC’s action after the regular market close on March 22, but the shares have still nearly doubled since year-end 2022. Coinbase’s enterprise value is around US$16 billion.

The stakes for Coinbase are enormous. The SEC may determine that altcoins, or alternative digital currencies to Bitcoin like Ethereum, Ripple, Tether, or Bitcoin Cash, may require formal SEC registration as securities in order to be traded. If the SEC were to deny those applications, Coinbase’s revenue power would be significantly impacted.

As has been its pattern, Coinbase has maintained a combative tone against the SEC in its public release and Twitter comments after receipt of the Wells Notice. One of Coinbase’s main points is that when the SEC approved its own registration statement approving the issuance of stock to investors, that was tantamount to the regulatory body’s approving its business lines.

More correctly, the SEC reviews a company’s registration filing only to ensure the regulatory body’s disclosure rules are satisfied, the most important of which is that all material, relevant information has been disclosed. The SEC’s determining a registration statement is effective is not an endorsement of a company’s products. For example, the SEC’s approving a software company’s S-1 filing for an initial public offering does not mean the software created by that company is useful.

A concerning precedent for Coinbase is the SEC’s March 2022 case filed against LBRY, Inc., a software firm that issued crypto asset securities called “LBRY Credits.” LBRY did not register the credits as a security, saying they were simply a digital currency. In November 2022, a federal judge granted the SEC’s motion for a summary judgment against LBRY.

Coinbase’s financials cannot be considered a positive. Despite posting a slight uptick in sequential revenue in 4Q 2022, Coinbase’s adjusted EBITDA loss widened to US$124 million from negative US$116 million in 3Q 2022. The company’s full-year 2022 EBITDA loss was US$371 million.

Not surprisingly, Coinbase’s cash holdings eroded quite rapidly over the course of 2022. At year-end 2022, the company’s cash totaled US$4.4 billion, down from US$7.1 billion as of December 31, 2021.

COINBASE GLOBAL, INC.

| (in millions of US dollars, except otherwise noted) | 1Q 2023E | 4Q 2022 | 3Q 2022 | 2Q 2022 | 1Q 2022 |

| Transaction Revenue | $322 | $366 | $655 | $1,013 | |

| Blockchain Rewards | $62 | $63 | $68 | $82 | |

| Custodial Fee Revenue | $11 | $15 | $22 | $32 | |

| Interest Income | $182 | $102 | $33 | $11 | |

| Other Subscription and Services Revenue | $27 | $31 | $24 | $28 | |

| Total Subscription/Services Revenue | $300 to $325 | $283 | $211 | $147 | $152 |

| Net Revenue | $605 | $576 | $803 | $1,165 | |

| Transaction Expenses as % of Net Revenue | ~15% | 14% | 18% | 21% | 24% |

| Sales & Marketing Expenses as % of Net Revenue | 15% | 13% | 18% | 17% | |

| Technology and Development Plus G&A Expenses | ~$650 | $968 | $896 | $1,079 | $984 |

| Adjusted EBITDA | ($124) | ($116) | ($151) | $20 | |

| Net Income – Recurring | ($557) | ($545) | ($647) | ($430) | |

| Cash, Including Digital Assets | $4,425 | $5,007 | $5,682 | $6,116 | |

| Debt – Period End | $3,469 | $3,474 | $3,483 | $3,486 | |

| Shares Outstanding (millions) | 261.9 | 261.9 | 261.9 | 261.9 |

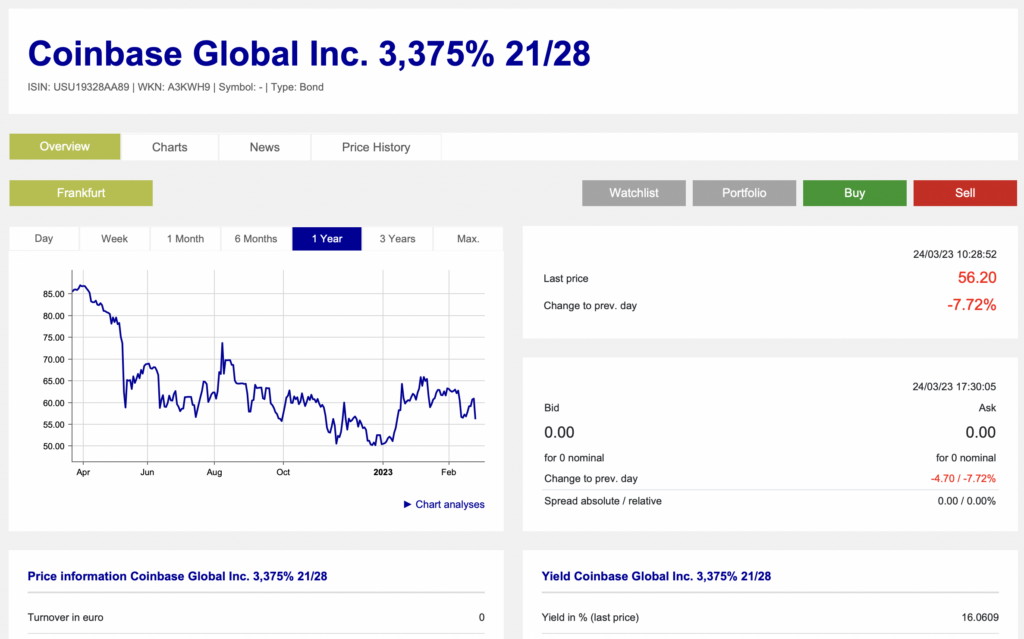

Coinbase’s 3.375% bond which matures in 2028 has rallied this year, but at a much more tempered pace than Coinbase stock. The bond last traded well below par at 56.20, equivalent to a 16.1% yield. Coinbase’s fixed income investors seem to be much more skeptical than equity investors.

Coinbase Global, Inc. last traded at US$67.83 on the NASDAQ.

Information for this briefing was found via Edgar, the SEC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.