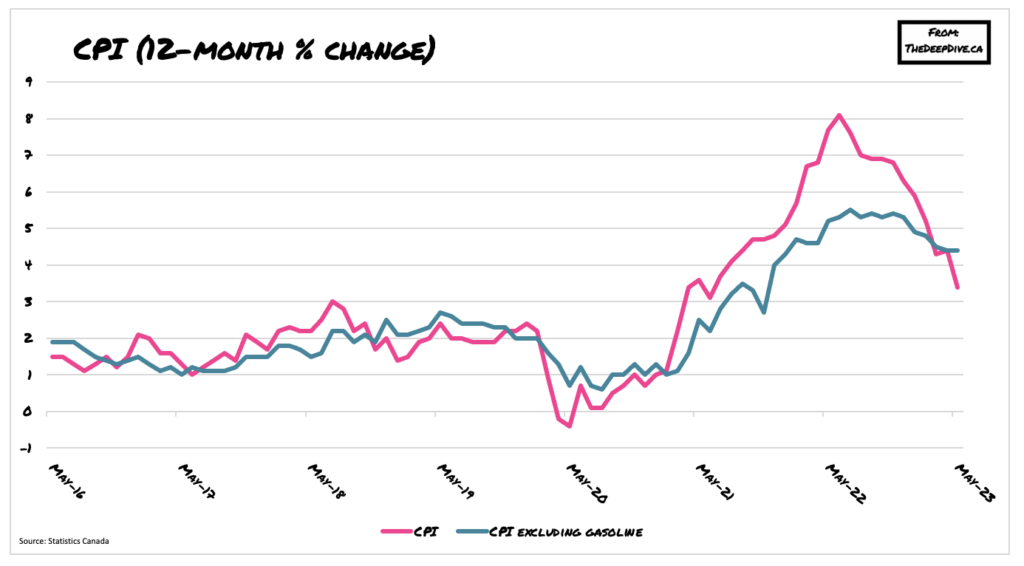

Latest data from Statistics Canada shows consumer prices rose 0.4% month-over-month to an annualized 3.4% in May, marking a substantial decline from April’s 4.4% reading and in line with economists’ forecasts. There is just one catch, though: last month’s decline was largely fed by lower gasoline prices, thanks to the base-year-effect— grocery prices are still stubbornly elevated, and mortgage interest costs continue to skyrocket by the sharpest pace on record.

Food and energy aside, core CPI jumped 4.0% on an annual basis, following a 4.4% increase in the month before and above expectations calling for a print of 3.9%.

Looking closer at the components, energy prices slumped 12.4% from May 2022, largely due to base-year effects stemming from last year’s global economic uncertainty surrounding Russia’s military operation in Ukraine. On a monthly basis, gasoline prices fell 0.8%, and are down 18.3% compared to one year ago.

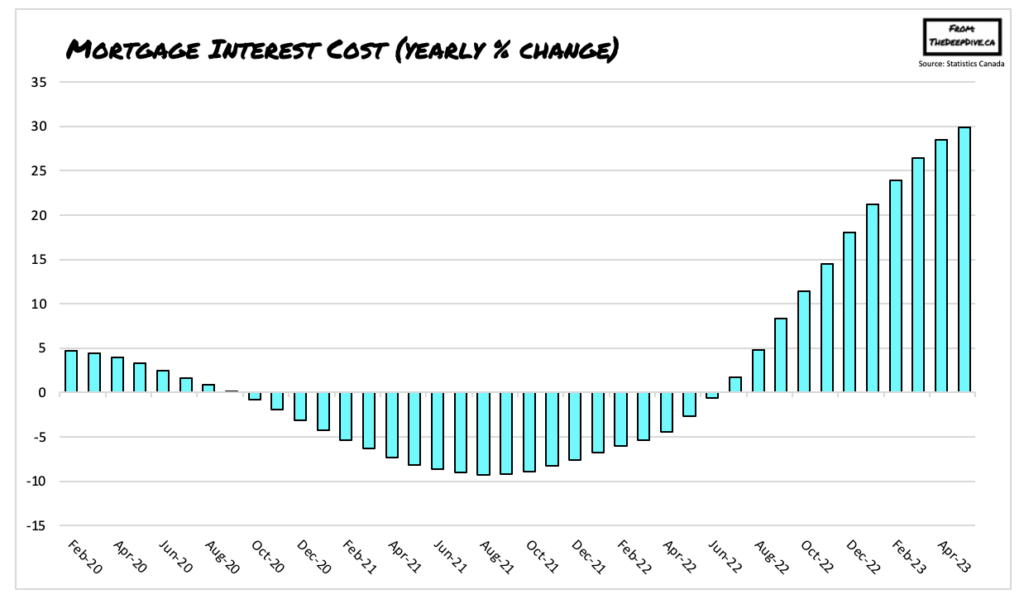

Base-year effects aside, mortgage interest cost was the largest contributor to May’s CPI increase, rising a staggering 29.9% year-over-year following a 28.5% gain the month before. This marks the third consecutive record-breaking increase, and homebuyers taking on, or renewing mortgages at exceptionally high interest rates. Excluding mortgage interest costs, May’s CPI print would have come in at only 2.5%.

Meanwhile, Canadians’ wallets are feeling the strain as they attempt to put food on the table. Statistics Canada reported that grocery prices rose 9% year-over-year in May, relatively unchanged from April’s reading of 9.1% and more than twice as high as headline CPI. Prices for food purchased from restaurants also increased by a sharper pace, rising 6.8% year-over-year compared to a 6.4% annual increase in the month before.

The Bank of Canada’s next rate decision is scheduled for July 12, and economists are bracing for another hike. TD Bank economist Derek Burleton is expecting policy makers to bring borrowing costs to 5%, resulting in a significant economic slowdown and even a potential recession.

2.5% CPI in Canada for May when you exclude MORTGAGE INTEREST COST which was the largest contributor to CPI.

— James E. Thorne (@DrJStrategy) June 27, 2023

So raising rates is inflationary!!

So I guess this means the BoC will raise rates again to contribute to more inflation.

👇 pic.twitter.com/IMHim7DMPu

Editors note: A previous version of this article incorrectly identified core CPI as being 4.4%, instead of 4.0%, while the prior month data was incorrectly stated as 4.1%, instead of 4.4%. We apologize for this error.

Information for this story was found via Statistics Canada. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.