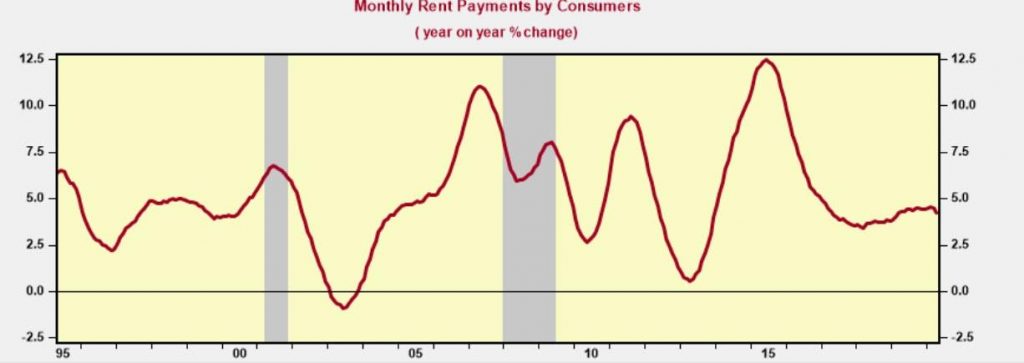

The US federal government has been issuing a monthly report which measures consumer spending. The report has been particularly vital during the coronavirus pandemic, as it provides a vital perspective on the well-being of the US economy. For the month of April 2020 for example, consumer spending on rent increased by $1.6 billion to $639 billion; although suggestive of a potential recovery on the horizon, that is unfortunately not the case.

Although the BEA’s data shows an increase in rent payments, surveys and press reports suggest otherwise. Independent data compilations have found that approximately only two thirds of Americans have actually paid their monthly rent, thus indicating that the government’s monthly report on consumer spending is quite inaccurate. The reason for this inaccuracy? According to an official with the BEA, rent payments are analyzed on an accrual basis – meaning that if the rental unit is occupied at the time of data collection, it is assumed the consumer has been diligent on their rent payments.

However, if one third of Americans have failed to make their rent payment for the month of April as the independent data suggests, then consumer spending has actually decreased by an additional $200 billion. Thus, the consumer spending decrease as outlined by the BEA is significantly understated. Going forward, there most likely won’t be much of a speedy recovery concerning consumer spending given the grim re-adjusted outlook. The unemployment rate continues to rise, and now at least one third of Americans are behind on their rent payments – the next few months will certainly be chaotic.

Information for this briefing was found via Zero Hedge and the Bureau of Economic Analysis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.