Crop Infrastructure Corp (CSE: CROP) filed its first quarter results this evening, posting a loss of C$3.38 million, or $0.02 per share. The firm has yet to post revenues despite its repeated investments in associates.

Through the first quarter of the fiscal year for Crop Corp, the entity managed to burn through its cash reserves to the tune of $5.58 million, leaving only $86,661 in the till as of May 31, 2019. The largest expenditure during the quarter was that of advertising and promotion, which utilized just over $1.7m in the three month period.

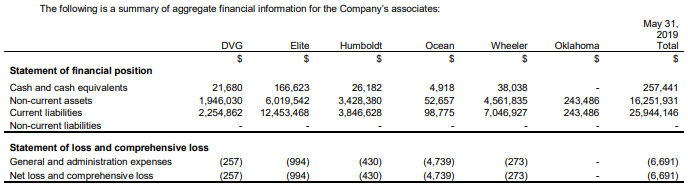

Shareholders may see a glimmer of light at the end of the tunnel however, as the firms associates now owe the firm over $22.6 million across all Crop Corp’s investment. The balance sheet line item saw a net increase of $7,353,261 over the quarter from further investments from Corp. However, liabilities still outnumber total assets of the investments by a significant amount, with the entities collectively owing over $25 million. More concerning, is that the investments have yet to begin any repayments to Crop Corp, despite the constant cash infusion occurring.

Accounts payable are also beginning to pile up for Crop Corp, with the line item seeing a net increase of $76,000 over the quarter, with cash reserves unable to cover the bills. This is likely the reasoning behind Crop Infrastructure’s financing conducted in June, which saw $1.25 million worth of debentures sold for $1 million. At the time the company advertised it as being a “20% discount to face value.”

Finally, it appears that Crop Infrastructure Corp has also found itself the subject of a lawsuit. Filed by a former contractor and tradesperson, no further details are given by the company. The lawsuit was filed subsequent to the period end for the reporting period.

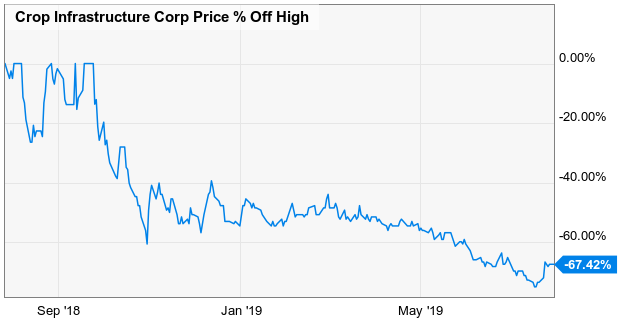

Crop Infrastructure Corp closed todays session at $0.22, flat on the days trading. The stock is down over 67% from it’s 52 week high.

Information for this briefing was found via Sedar and Crop Infrastructure Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.