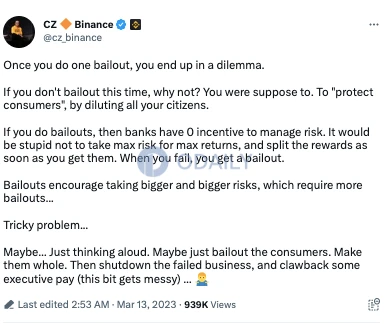

In a now-deleted tweet, Binance CEO Changpeng “CZ” Zhao warned followers about the dangers of bailouts, saying “once you do one bailout, you end up in a dilemma.”

His comment is a stark reversal from just in November when he said that Binance was “forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis.”

To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify. 1/2

— CZ 🔶 Binance (@cz_binance) November 14, 2022

Twitter user DeFiac asked CZ if this was his “thought process with FTX,” and the Binance chief was quick to defend his now-deleted remarks, denying that the FTX scenario was a bailout. “One business buying another one with their hard-earned money is not a bailout (as in printed money),” he said.

Since you are the biggest player in crypto, I'd imagine you faced somewhat similar dilemma.

— DeFiac (@TheDEFIac) March 12, 2023

Buying FTX – helps a lot of customers, possibly keeps many players in the game.

Not doing so – shows that we need no bailout and thats part of what crypto is trying to solve.

His remarks attempt to highlight crypto’s strength as three US banks shuttered in just the past week.

CZ has spent a good part of the past few months calling FUD on anything bad published about Binance following the FTX collapse and amid the government’s attempts to rein in the crypto industry.

They FUD us, and banks fail. 🤷♂️ https://t.co/DyrIESJRjP

— CZ 🔶 Binance (@cz_binance) March 11, 2023

Following the bailout tweet, CZ took a victory lap and announced that the remaining amount in the Industry Recovery Initiative funds will be converted from stablecoin to native crypto.

The transfer txid. Took 15 seconds and costs $1.29. Imagine moving $980 million through a bank before banking hours on a Monday. https://t.co/ViCppASVFK

— CZ 🔶 Binance (@cz_binance) March 13, 2023

It might be too early for that lap, though. A recent report from the Wall Street Journal revealed that Binance reportedly devised a strategy to escape prosecution by regulatory authorities when it established its US entity in 2019, according to internal messages and documents from 2018 to 2020 and interviews with former employees. If US regulators conclude that Binance has control over its US entity, they may assert authority over Binance’s whole business.

Information for this briefing was found via Twitter, Reuters, Coin Desk, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.