Former U.S. President Donald Trump’s SPAC stock, Digital World Acquisition Corp. (NASDAQ: DWAC) spiked 14% higher on January 11 to US$63.80 on no apparent news. While many current SPACs are trading poorly, SPAC sponsor DWAC has enjoyed a much more constructive trajectory.

However, given the uncertainties faced by DWAC and its extraordinarily high valuation for a company with no revenue, operating history or CEO with any social media operating experience, investors may want to cut or eliminate exposure to the stock. The risk-reward trade-off does not appear to be a positive one at its present valuation.

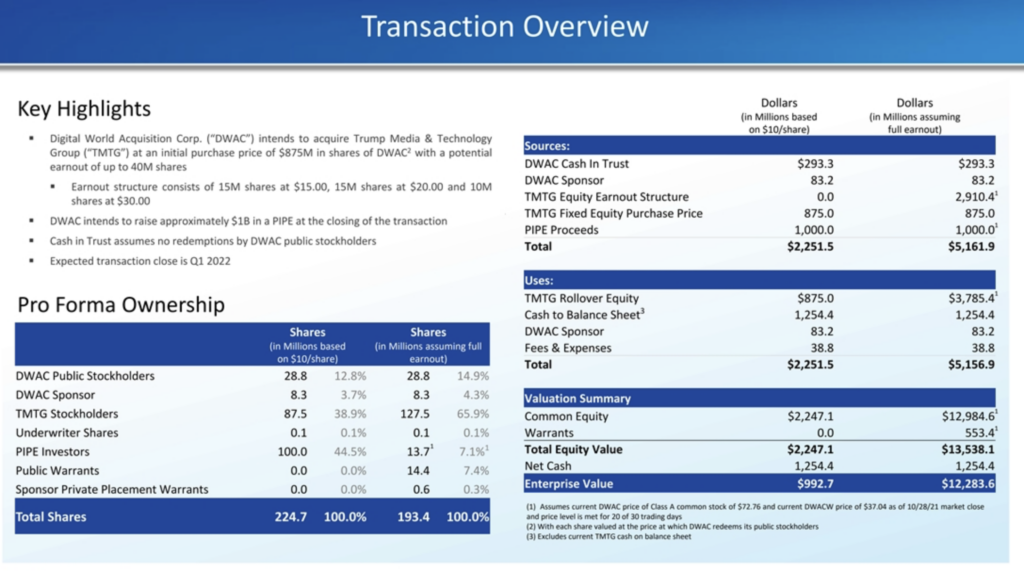

As background, former President Donald Trump, perhaps the most polarizing world figure in decades, announced an agreement in mid-October 2021 whereby the Trump Media & Technology Group (TMTG) will merge in a SPAC transaction with SPAC sponsor DWAC. TMTG plans to launch a conservative social network called TRUTH Social, effectively a conservative version of Twitter. According to a listing in Apple’s App Store, TRUTH Social will launch on February 21, 2022. Ultimately, after regulatory and shareholder approval, TMTG would become the surviving publicly traded company.

Two key aspects of the deal could potentially cause the SEC to issue a fraud charge or, worse, stop the deal. If the deal were stopped, it is possible that investors would recover only US$10 per share. As noted above, DWAC currently trades at US$63.80.

First, ARC Capital, a Shanghai-based firm, is listed in SEC filings as an official advisor to DWAC. In 2017, the SEC sued to block the IPOs of three companies — Go EZ Corp., Arc Lifestyle Group Inc., and Nova Smart Solutions Inc. — in which the four ARC principals held key roles. The SEC cited misstatements of the nature and scope of the businesses and failure to cooperate with regulators as reasons to block the offerings.

In all three cases, a judge agreed to issue a stop order, preventing the companies from going public. To illustrate how unusual it is for the SEC to issue a stop order forbidding an offering from going forward and, perhaps more importantly, the low standing with which the SEC views ARC Capital, the SEC has only issued 42 stop orders over the past 25 years.

Second, a SPAC sponsor, which is also known as a “blank check company,” cannot by law have any existing business or even a stated acquisition target when it files to go public. The New York Times reported in October 2021 that former President Trump began discussing a transaction with the DWAC CEO in March 2021 or possibly earlier. However, in its May 2021 go-public filings with the SEC, DWAC said it had “not selected any specific business target” nor had it “initiated any substantive discussions, directly or indirectly, with any business combination target.” DWAC’s IPO closed in early September 2021.

On December 6, 2021, DWAC disclosed in an 8-K filing that it had received “preliminary fact-find inquiries” from the Financial Industry Regulatory Authority (FINRA) in late October and early November 2021. In the same 8-K, DWAC said that the SEC asked for information on the company’s board meetings, as well as information regarding investors and communications.

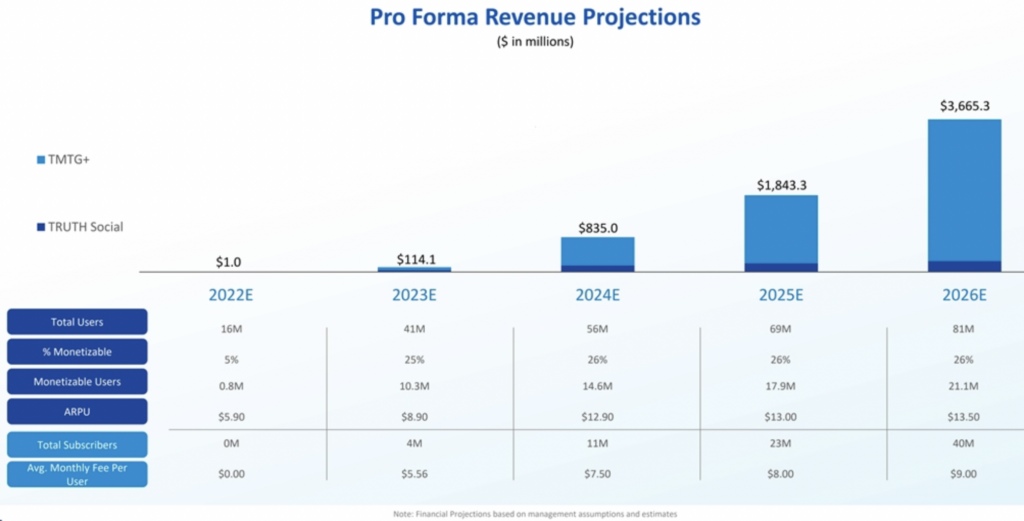

At its current share price, DWAC has an enterprise value (EV) of more than US$12.3 billion despite having no operating history and the likelihood that it will incur losses and operating cash flow shortfalls for years. In addition, like many electric vehicle SPAC OEMs, it forecasts modest revenue in its early years (2022 and 2023), and then a revenue explosion in the fairly distant future — despite articulating little more than a business plan in its public filings.

(DWAC’s current EV cannot be specified because the company’s projections, which were made in November 2021, do not identify the precise share price on which they are based. Its January 11, 2022 closing price was higher than any share price achieved in November 2021.)

Digital World Acquisition Corp. last traded at US$63.80 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

Enterprise value is market cap, minus cash on hand, PLUS debt.

The metric is used to value a business as though one were purchasing it. The cash is subtracted, because it’s valued at par, and the debt is added as a metric of the company’s credit. I haven’t checked Jim’s EV calculation for DWAC, but that’s the formula.

I’m not sure how the author arrived at the enterprise value. Share price x shares issued minus debt would be the method commonly used. If we include stock warrants in the calculation I obtain the following: $63.8/share x (30.3 million shares + 12.5 million wrrant shares) = $63.8 x 42.7 E6 = $2.72 billion. I believe other finacial media outlets are reporting about $2.5 billion as capitalization. Assuming DWAC has no significant debt.

Sounds like the cuck writer suffers from TDS. I’m gettin nigga rich over here, thanks Trump!

You are insane.