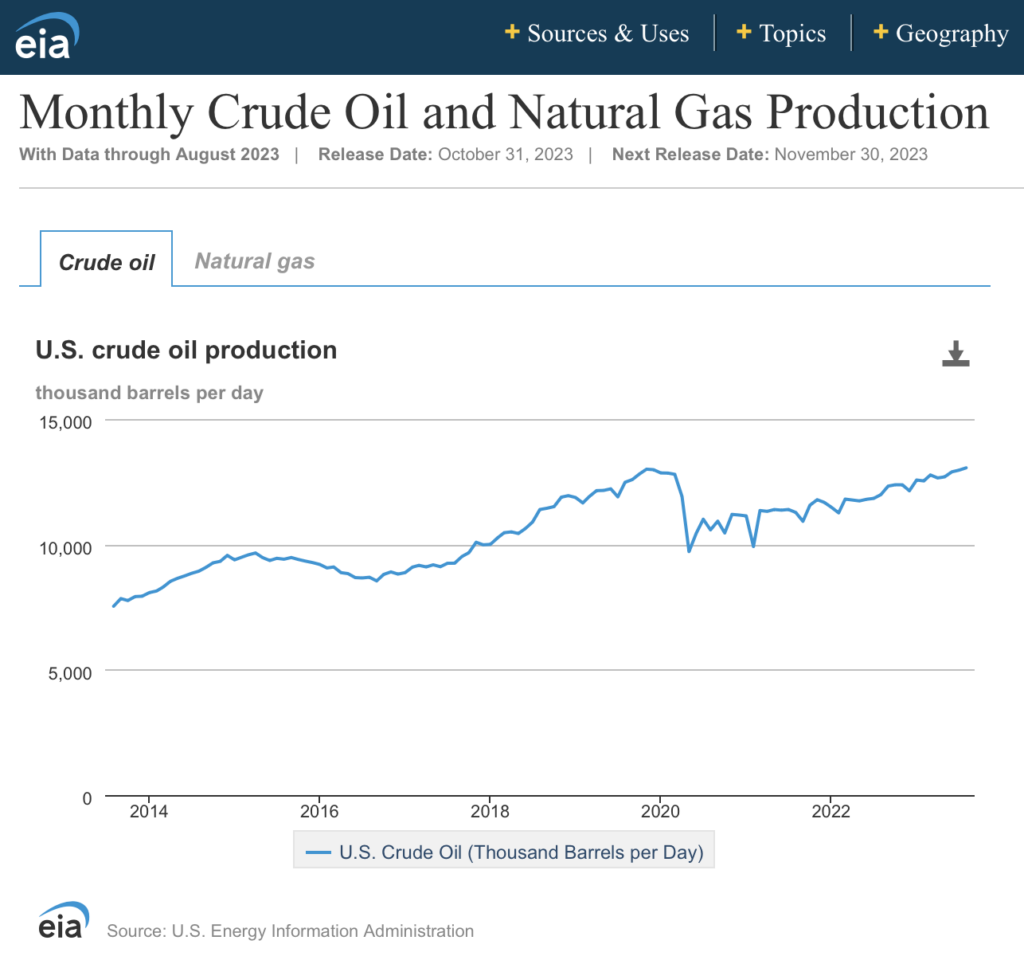

The Energy Information Administration (EIA) released its monthly U.S. oil data for August yesterday, with the spotlight shining on the “record” U.S. oil production, which reached 13.053 million barrels per day (b/d). However, a closer look at the report reveals a more complex story.

HFI Research expounds that the initial attention-grabbing figure of a one-million-b/d growth from December to August can be misleading. This is primarily due to weather-related disruptions in December, which resulted in production shut-ins. Additionally, the EIA altered its methodology for calculating crude production, leading to increased volatility in the adjustment figure.

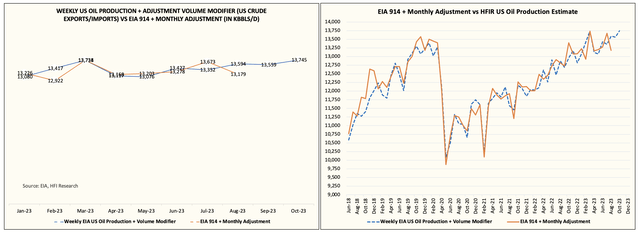

The shift from a consistently positive adjustment to a consistently negative one is evident. The July adjustment was a positive 65,000 b/d, while the August adjustment dipped to a negative 632,000 b/d. Averaging these two figures yields a negative 283,500 b/d, and the June adjustment was negative 200,000 b/d.

This pattern suggests that the EIA has addressed the consistent adjustment issue but is now overestimating U.S. oil production, leading to the adjustment consistently skewing negative.

HFIR said its approach to analyzing U.S. oil production has always involved adding reported oil production and accounting for the adjustment to obtain the true production figure. Fortunately, the EIA provides data on transfers to crude oil supply, aiding in determining the adjustment’s impact on blending.

“Transfers to crude oil supply for July and August came in at 617 and 758, respectively. The average is ~688k b/d. We can subtract this from the average total supply to get the ‘real’ U.S. crude production. The net result is 12.738 million b/d,” HFIR said.

In summary, the reported U.S. oil production from the EIA is overstating production, leading to a consistently negative adjustment.

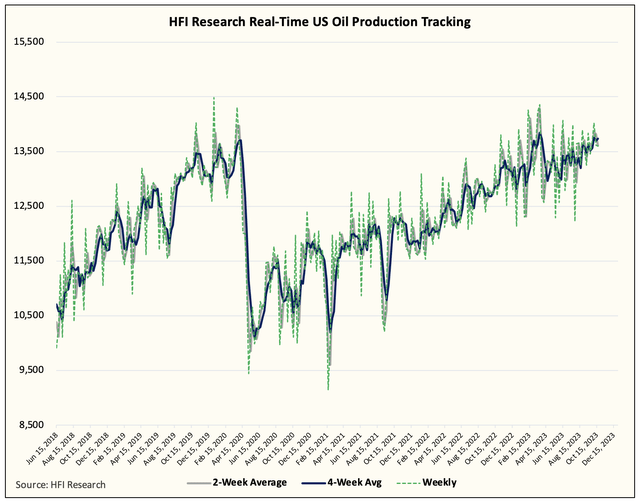

Substantiating further its belief that U.S. oil production has increased, but not to the extent reported by the EIA, HFIR referred to its own high-frequency U.S. oil production tracker. Their estimate for U.S. oil production at the end of 2022 was approximately 13 million b/d of total supplies, or around 12.4 million b/d when excluding transfers to crude oil.

“This means that since the end of 2022, U.S. oil production has grown ~400k b/d or so. This is in stark contrast to the ~1 million b/d growth reported on the headline,” HFIR emphasized.

The tracking problem

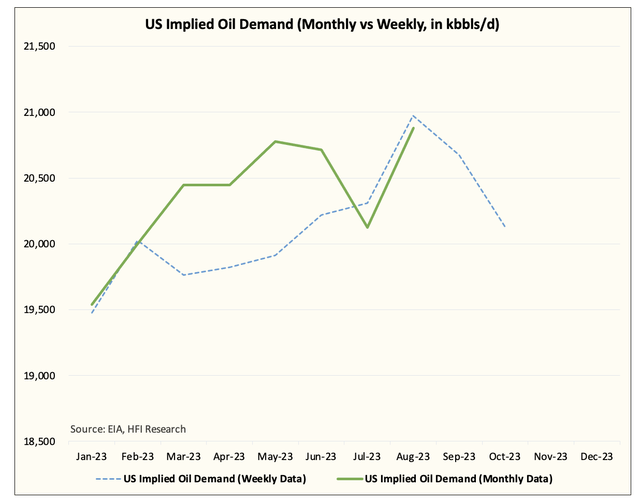

The problems with EIA’s data reporting extend to U.S. implied oil demand, especially in the “big three” categories (gasoline, distillate, and jet fuel). While total implied oil demand also faces issues, they are not as severe, and inconsistencies between weekly and monthly data exacerbate the problem.

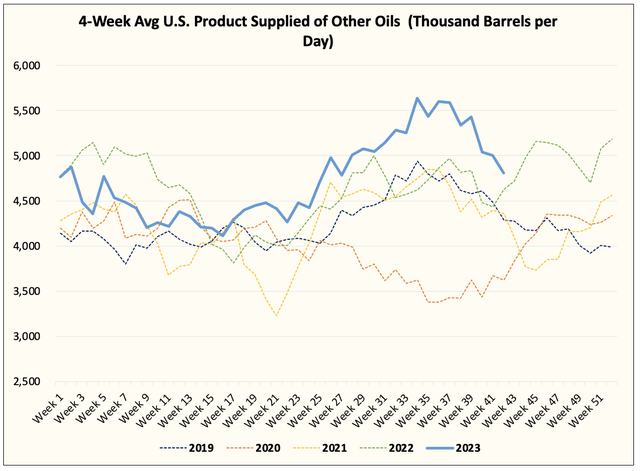

The root of the issue seems to lie with “other oils.” This category appeared to hit a record high around August. The EIA’s monthly data places the “other oil” category at approximately 2 million b/d, consistent year-to-date. The weekly survey’s inability to accurately capture data for each category may explain these discrepancies, prompting the EIA to reconsider its methodology.

“We applaud the EIA for trying. But in its latest attempt at eliminating the adjustment factor, it is now overstating U.S. oil production,” the research body said. “U.S. oil production is not as high as the headline states and U.S. oil demand is not as bad as the weekly data suggests.”

According to the EIA in August, US oil production is on a surge and is anticipated to outpace earlier projections made this year.

Information for this story was found via Seeking Alpha and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.