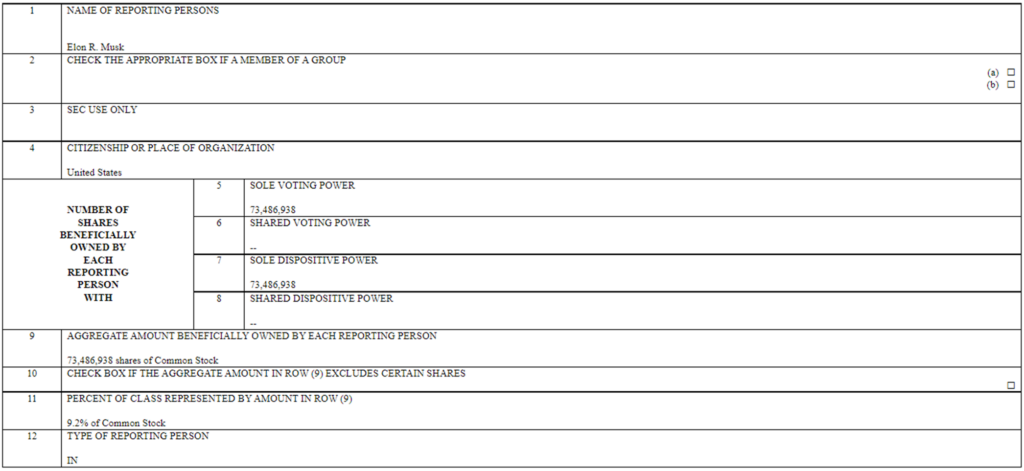

In a move that apparently no one saw coming, Tesla (Nasdaq: TSLA) CEO Elon Musk bought 73.4 million shares of Twitter (NYSE: TWTR), roughly 9.2% equity, according to an SEC filing dated March 14. After the purchase was made public, the social media giant’s stock rallied pre-market by as much as 25%.

This makes Musk, through Elon Musk Revocable Trust, the largest single shareholder of Twitter. With the shares trading pre-market with an approximately 20% spike as of this writing, Musk’s investment in the social media platform has generated at least around US$587 million in unrealized gains.

@elonmusk is now the largest $TWTR shareholder, 73MM shares. pic.twitter.com/K3HZneDExH

— Chris Perruna (@cperruna) April 4, 2022

The news came after Musk tweeted a week ago a poll asking his followers if Twitter “rigorously adheres to [free speech] principle.” Garnering around two million votes, the poll saw 70.4% voting “no”.

He added that the consequences of the poll’s results “will be important.” After the results, Musk touted the possibility of a new platform–to which most followers inferred that the Tesla chief would be planning to create his own social media site.

Is a new platform needed?

— Elon Musk (@elonmusk) March 26, 2022

The consequences of this poll will be important. Please vote carefully.

— Elon Musk (@elonmusk) March 25, 2022

But apparently, Musk already bought the shares before he put out the Twitter poll, putting his tweets a week ago in a different context now.

$TWTR he attacked Twitter to drop the price while he was accumulating shares..😂😂😂 ☑

— Judah (@tugasdatmin) April 4, 2022

This is not the first time that Musk democratized his investment moves through a poll on the social media platform. Musk also polled his decision to sell 10% of his Tesla stocks, which led to an SEC probe that resulted in his 2018 agreement with the agency to review his tweets. He is currently challenging to quash this agreement but the regulatory body said it “may legitimately investigate matters relating to Tesla’s disclosure controls and procedures, including Musk’s tweets about Tesla.”

But Musk can’t be separated from his incessant use of the platform. Aside from making comical tweets and replying to other users, he also shares his positions on the world and economic views, including inflation, pushes for nuclear power, and calls for increasing domestic oil production.

Sometimes, he also challenges Russian Vladimir Putin to a physical fight; or picks a fight with a teenager publishing his private jet’s flight routes on Twitter.

While holding around 9.2% equity won’t necessarily make Musk a big voice on the Twitter board and the 13G filing means that his investment is passive, many are speculating the motive behind the investment.

World’s richest man makes multi-billion dollar investment in $TWTR then immediately tweets about changes that should occur (open source/free speech) but also files a 13G claiming passive. No way this guy can stay passive. Its not in his blood.

— Rob Schmied (@rschmied) April 4, 2022

So let’s do the math quickly:

— Q-Cap (@qcapital2020) April 4, 2022

Elon bought 9.2% of $TWTR or 73,486,938 shares.

Stock is up 25% pre market.

73.4M shares * 9.88$ = 725M$ unrealized profits

Not too shabby from a Twitter Poll !

1. Elon Musk takes a 9% stake on $TWTR

— Leandro (@Invesquotes) April 4, 2022

2. Shares jump 25% on the news

3. Elon Musk just made 25% gain without the company changing one bit

4. The market acknowledges 25% as the new risk-free rate

Who said investing was difficult?

Please push for $TWTR to increase the character count to 420 @elonmusk

— squawksquare (@squawksquare) April 4, 2022

Twitter last traded at US$39.31 on the NYSE.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.