enCore Energy (TSXV: EU) officially has multiple producing assets in its portfolio. The uranium producer this morning revealed that production has begun at its Alta Mesa Uranium Central Processing Plant and Wellfield.

With the start of production at Alta Mesa, enCore becomes the only US uranium producer with multiple facilities in operation, which follows the start of production at Rosita late last year. Both of the firms operating assests are located within southern Texas.

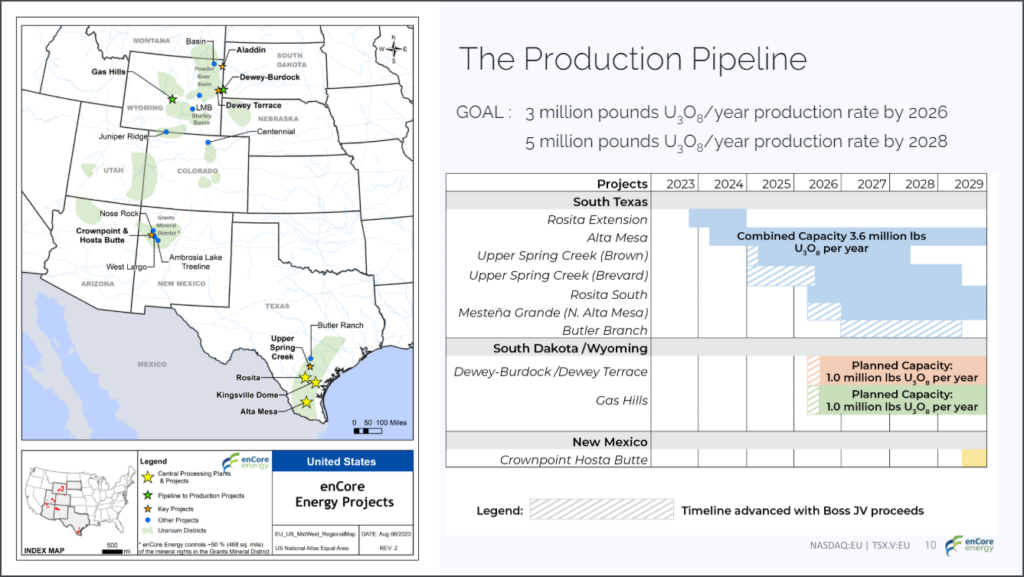

While initial production is expected to be low, enCore anticipates that full operating capacity will be achieved by 2026. The facility is presently licensed for 1.5 million pounds of U3O8 production per year, with additional drying capacity of 0.5 million pounds. The first shipment of U3O8 is expected from the facility within 60 to 90 days.

“Our strategy at Alta Mesa is to initiate phased ramp-up from the wellfield located in Production Authorization Area 7 (“PAA-7”), increasing production progressively and consistently as additional injection and recovery wells are systematically tied into the production lines. As we continue to increase production from PAA-7, work has commenced on the second new wellfield at Production Authorization Area 8 (“PAA-8″) with a goal of achieving full operational capacity by 2026. We are very pleased with our initial early production providing enCore with a second revenue source as we continue to build out the Alta Mesa Project,” commented CEO Paul Goranson.

READ: enCore Energy Suspends ATM Financing Following First Uranium Shipment

The Alta Mesa project consists of over 200,000 acres of prospective claims, of which only 5% has been explored to date. 52 linear miles of stacked uranium roll fronts are said to have been identified so far at the property, five miles of which have been explored.

Alta Mesa is a 70/30 joint venture partnership between enCore and Boss Energy.

enCore Energy last traded at $5.54 on the TSX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.