On June 22nd, Equinox Gold Corp. (TSX: EQX) announced that there has been illegal blockades set up at the Los Filos Mine which has been orchestrated by “a group of unionized employees and members of the Xochipala community, both of whom are demanding payments in excess of their contractual agreements.” This news slumped Equinox’s share price by only 3.76%.

A few analysts came out and lowered their price targets off the back of this news, bringing the consensus 12-month price target down to C$17.52, or an 85% upside. Out of the 12 analysts, one analyst has a strong buy rating, eight have buy ratings and three have hold ratings. Modelyze Investments has the street high at C$22.76 while the lowest sits at C$13 from Desjardins.

BMO’s note to investors downgraded their 12-month price target to C$18.50 from C$20.00 and reiterated their outperform rating on the name. Ryan Thompson, their analyst, says that this is a “disappointing setback” for Equinox as it’s their second blockage in nine months.

The first blockade happened in September of 2020, where the Carrizalillo community blockaded the operation and the company regained access temporarily for four days in November but was officially restarted three months later at the end of December.

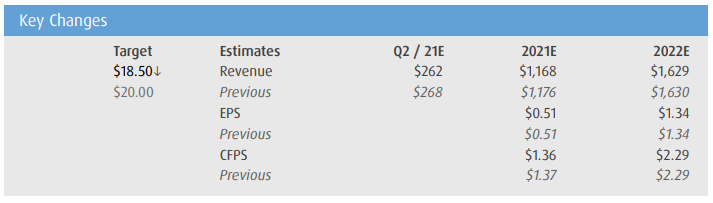

Below you can see BMO’s key changes for the second quarter, 2021, and 2022. They have slightly decreased revenue due to Los Filos being 28% of their NAV and 2021 production estimates. They have the mine producing 180k ounces and value the mine at C$1.2 billion.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.