In yet another testament that inflation is anything but temporary, price pressures across the euro zone soared to the highest on record in November, further adding to debate regarding the EU central bank’s ultra-dovish monetary policy.

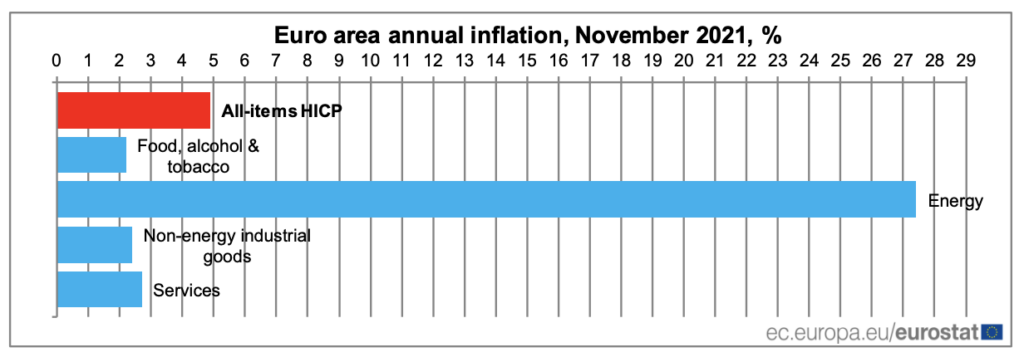

According to preliminary data published by Eurostat on Tuesday, inflation across the euro zone hit an astounding annual rate of 4.9% in November, outpacing a forecast of 4.5% by economists polled by Reuters. The latest figure was also significantly higher than October’s inflation rate of 4.1%, and the highest on records dating back 25 years.

The majority of the latest inflation escalation was largely due to a jump in energy prices, which rose from an annualized 23.7% in October to 27.4% last month. In Germany alone, the inflation rate soared by 6% from the same period one year ago— the highest in nearly 30 years. Likewise, France also reported a price acceleration of 3.4%, marking the highest level since 2008.

The latest alarming figures come just as the World Health Organization announces the emergence of a new Covid-19 variant, threatening further uncertainty for the global economic recovery and financial markets. However, the persistently high inflation will also make it increasingly difficult for the European Central Bank to continue its unprecedented quantitative easing program, and refrain from an interest rate hike before 2023.

Information for this briefing was found via Eurostat. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.