It appears that one of the strategic alternatives that iAnthus Capital Holdings (CSE: IAN) is considering for shareholders may be that of a potential management buyout offer. The Deep Dive has obtained documents that point to an offer for a management buyout being assembled by certain executives of the firm as a strategic alternative for the current liquidity crises faced by the company.

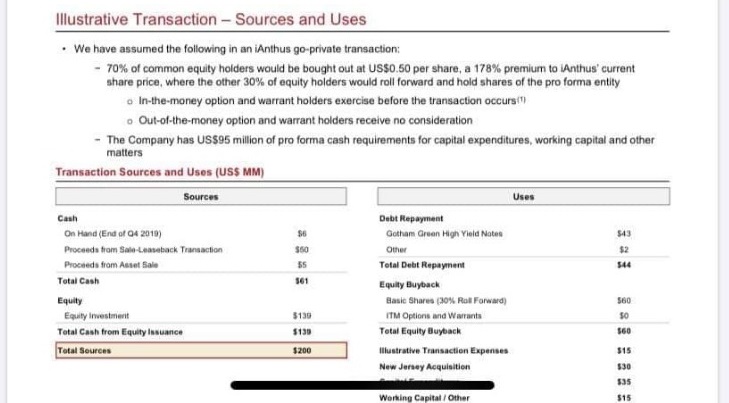

While the liquidity problem being faced by the company is no secret to long time shareholders, the proposal of a potential management buyout offer may come as a shock. While executives were unable to find further funds to support the operation in the current format, they may have now evidently found the capital needed to perform a go private transaction. The documents sourced indicate that a total equity investment of $139 million would be associated with the offer.

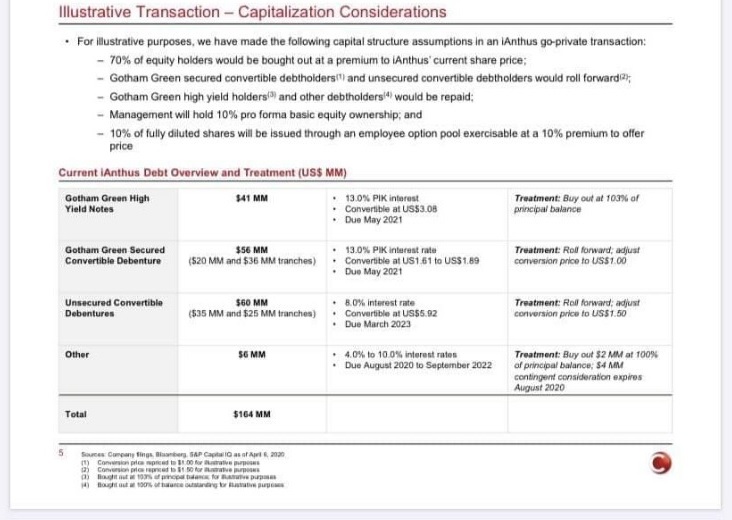

The proposal, which is allegedly being conducted by an entity referred to as “Saving Grace Capital, LLC,” consists of offering 70% of current shareholders a price per share of US$0.50 as per the documents sourced by The Deep Dive. Current in-the-money warrant and option holders would be eligible to exercise their units, however units that are not in the money would effectively expire worthless. Gotham Green meanwhile would see certain high yield holders and other debtholders repaid, while secured and unsecured convertible debenture holders would roll forward.

Included in the documents we received are management bio’s for that of Hadley Ford and Randy Maslow, whom are currently CEO and President of iAnthus respectively. No other bio’s were included within. The documents themselves identified that the presentation was a result of the need to raise $0.5 million to cover pre-closing fees of the potential transaction, and that they were intended only to “facilitate the discussions and negotiations between the parties of a possible business transaction.”

The documents are believed to be authentic, and The Deep Dive is currently working to further confirm the details on the matter.

iAnthus Capital Holdings last traded at $0.25 on the CSE.

Information for this briefing was found via Sedar and undisclosed sources. The author has no securities or affiliations related to any organization mentioned in this article. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

10 Responses

the perils of speculative investing. you win some you lose some. i’m underwater on this sucker, so 50 cents will ease the blow and I’ll move to better things.

This would be disgusting if they go private and the worst possible thing Ianthus could do to many MPX/Ianthus long/short term shareholders. I would hope that investors in this company choose to vote against it, regardless if our votes matters. Spread to media, if this is true. To those holding long or those that sold for a MAJOR loss – If this buyout becomes the case more lawsuits should follow, and in Canada. The premium looks attractive to newer buyers wanting to make a fast buck. To me, it seems as though the offer is at a premium from present share price because good things are in the pipeline for Ianthus. It’s no premium or strategic move to most shareholders. All up and up for Ianthus after going private, unless this is fake news about a private buyout.

How would this be fair? Why wouldn’t Ianthus do more to protect shareholders by finding a “better” offer? Why wouldn’t they sell assets already, before possibly going private? Instead, they’re spending more money on setting up shops for a possible private company buyout? If this buyout becomes the case, Hadley is not the guy I thought he is and was definitely only in this for short term personal gains. I hope that’s not true.

From Deep Dive: “It appears that one of the strategic alternatives that iAnthus Capital Holdings (CSE: IAN) is considering for shareholders may be that of a potential management buyout offer. The Deep Dive has obtained documents that point to an offer for a management buyout being assembled by certain executives of the firm as a strategic alternative for the current liquidity crises faced by the company.” “While executives were unable to find further funds to support the operation in the current format, they may have now evidently found the capital needed to perform a go private transaction. ”

Dressing up said offer as “strategic” and seemingly beautifying the deal for average shareholders is fake news and not convincing anyone. Only strategy is the lack thereof by Ianthus/Hadley, if this deal is made. In reality, it would be a piss poor and highly alarming move, if it were to be made. If it is made, get your internet media bots ready to post about the shade.

HEEELL NO!

This is in the best interest of shareholders, just like all those terrible convertible deals we did. And the time I tried to reprice my options at lows. And the fraudulent MPX transaction. Trust me guys.

another Wolfof WeedSt pump and dump.

Way to go Jason!

That looks like a Cormark pitch deck. The same clowns who gave said Jamiaca would have 10% of it’s GDP be cannabis.

Andy D involved?

Is this a good thing? Asking for a friend.

If iAnthus shareholders get 50c I guess that’s not such a bad thing right?

Yes, in all probability it’s a bad thing. I would bet that most shareholders have a weighted average acquisition cost way north of $.50. Mine is $4. The shareholders are getting screwed big time.

In addition to Ford blame Crapo and NY/NJ legislature. If the SFE banking act had gotten passed Ianthus would have had access to more funding.

Wow! I think we all know whats going to happen here. Management colluded against shareholders. Another brutal look for this team.