Well, here we are, another month come and gone, and another inflation print like no other.

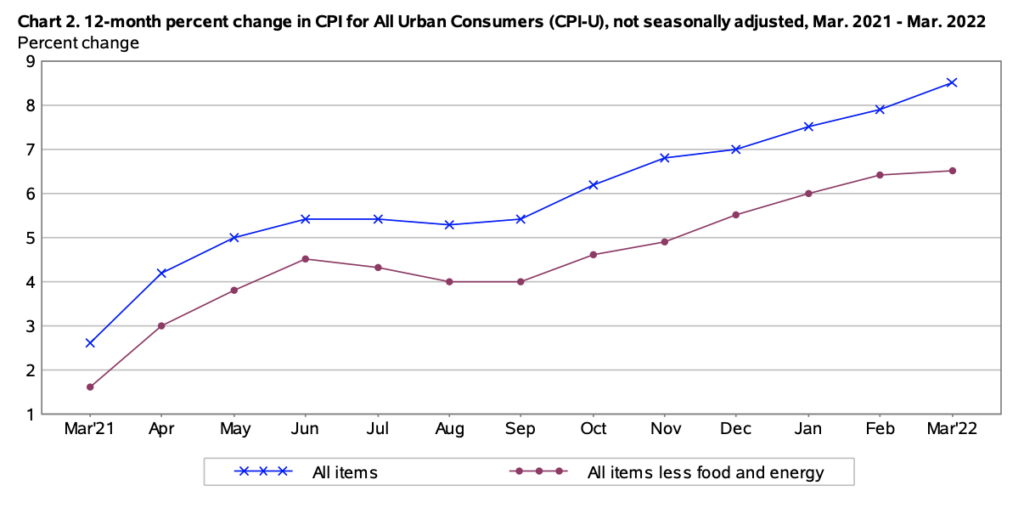

Someone please take the snooze button away from Fed Chair Jerome Powell, before the US economy sleepwalks further into catastrophe. The latest hot-off-the-press CPI print shows consumer prices exploding at an annualized 8.5%, higher than the highest of estimates calling for 8.4%, and the sharpest 12-month increase since December 1981. Making matters worse is core CPI, which was up 6.5%— just shy of the 6.6% forecast by economists, but nonetheless still the biggest jump since August 1982.

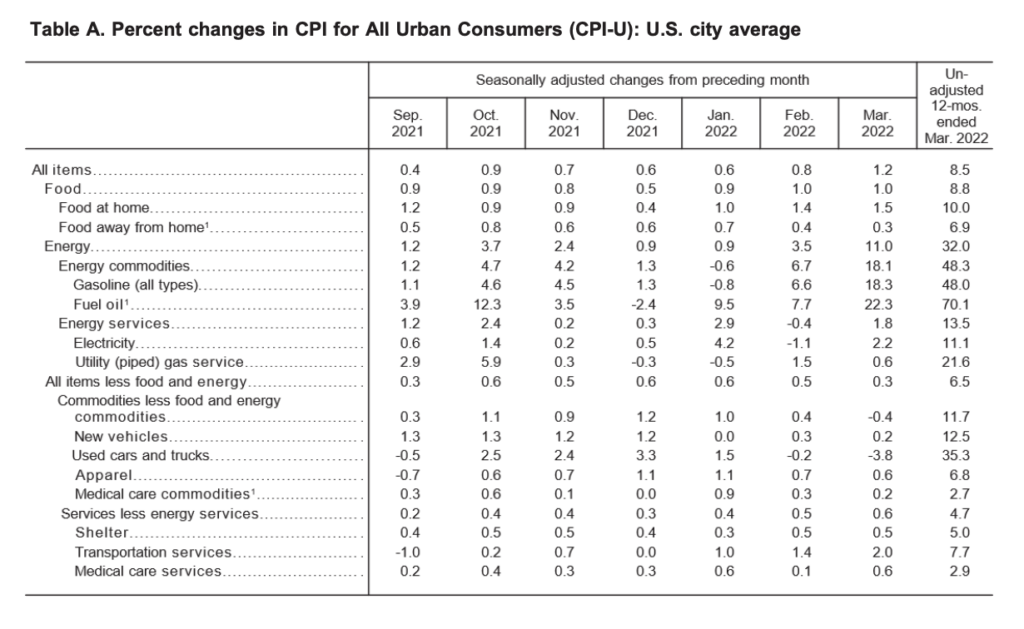

The White House was certainly right when Press Secretary Jen Psaki warned the world to brace itself for an “extraordinarily elevated” surge in consumer prices due to “Putin’s price hikes.” Looking under the hood, the majority of last month’s CPI print was primarily due to the shocking jump in energy prices, which skyrocketed 32%. Following close behind was a 35.3% increase in used cars and trucks, a 5% increase in the cost of shelter, and an 8.8% advance in food prices.

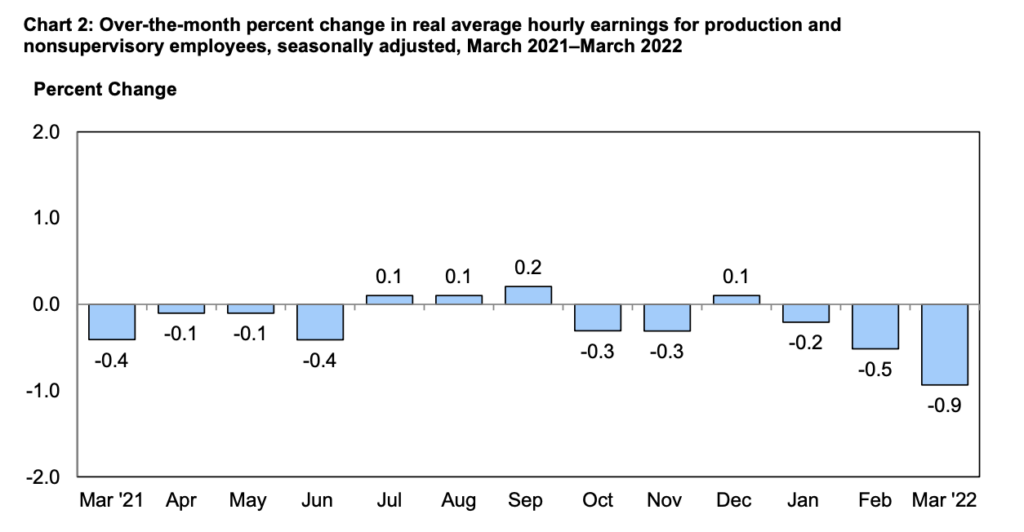

But, what is by far making matters considerably worse for the Average Americans’ pocketbook is the 12th consecutive decline in year-over-year real average hourly earnings…

So the next time someone tries to tell you that all of this is merely due to “Putin’s price hike,” just take a moment to replay this:

Remember this when they try to blame today’s CPI number on a “Putin price hike”.pic.twitter.com/lNDICLns5y

— Nate Anderson (@ClarityToast) April 12, 2022

Information for this briefing was found via the BLS and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.