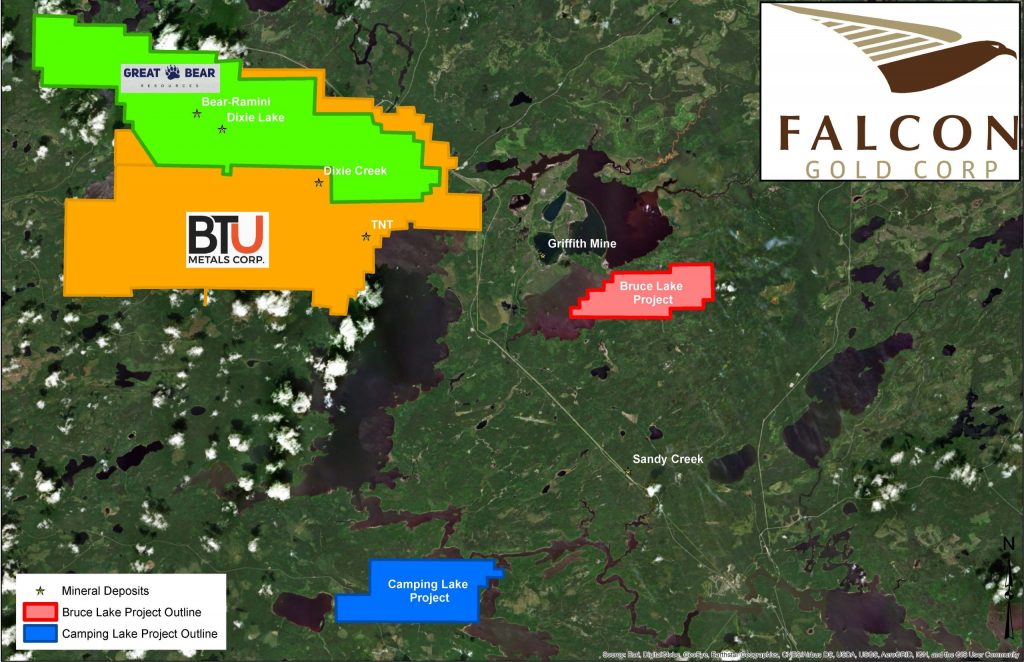

An exploration permit has been applied for by Falcon Gold (TSXV: FG) for the firms Bruce Lake Gold Project, located in the Red Lake Mining Camp. Once granted, the exploration permit will allow Falcon to perform overburden trench, line cutting and diamond drilling on the property to follow up on gold targets previously identified on site.

Falcon’s Bruce Lake Gold property is located in the well known Red Lake region, and consists of a 1,400 hectare property on the Bircg-Uchi-Confederation Lakes geenstone belt. The property hosts targets for both Red-Lake type gold mineralization, as well as gold bearing base metal prospects. Historical work on the property has included prospecting, sampling, and airborne magnetic geophysical surveys. This work revealed indicated gold and alteration mineral anomalies along the eastern shoreline of Bruce Lake in 2011, found by Laurentian Goldfield.

The same belt hosts the famed Dixie project currently being advanced by Great Bear Resources (TSXV: GBR). Great Bear has reported what is referred to as bonanza gold grades after conducting drilling on the property. Falcon’s Bruce Lake property is approximately 16 kilometers east of Great Bear’s claims.

Furthermore, the property is only 12 kilometers from that of property held by BTU Metals Corp (TSXV: BTU), with recent drilling revealing an assay result of 44.3 meters of 1.14% copper equivalent. Certain intervals on that property had as high as 5.56% copper, 99.6 g/t silver and 2 g/t gold.

Falcon Gold last traded at $0.065 on the TSX Venture.

FULL DISCLOSURE: Falcon Gold is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Falcon Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.