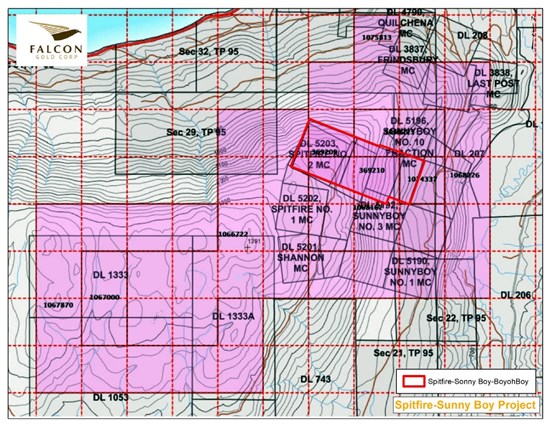

Falcon Gold Corp (TSXV: FG) was out with an update this morning, identifying that it has commenced field work at its land claims near Merritt, BC. The company will be conducting prospecting, field reconnaissance mapping, and channel sampling at the Spitfire-Sonny Boy project.

The field work being conducted will completed near the historic Master Vein which has sampled up to 50.53 ounces per tonne gold historically. The objective of the field work will be to delineate and constrain gold mineralization on the property. An exploration permit application has been submitted by Falcon, which outlines planned surface trenching and diamond drilling along the Master Vein zone.

Due diligence conducted on the property by Falcon Gold in 2019 confirmed the presence of gold mineralization on the property. The mineralization was found along the Master Vein, over a 300 metre strike length. Samples collected at the time measured 0.33 to 2.74 ounces per tonne of gold. Furthermore, recent data compiled on historical exploratory work on the property has indicated targets on the property for high grade gold vein deposits.

This previous work on the property has identified that structural mapping, EM and IP geophysics and a tightly spaced soil sampling grid is the best method for finding new mineralized structure gold and base metal discoveries.

The news of field work commencing follows last weeks announcement that the company has acquired additional land claims at the project.

Falcon Gold last traded at $0.065 on the TSX Venture.

FULL DISCLOSURE: Falcon Gold is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Falcon Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.