The Federal Deposit Insurance Corporation (FDIC) has officially commenced the marketing process for the approximately $33 billion commercial real estate (CRE) loan portfolio that remained in receivership following the failure of Signature Bank, headquartered in New York City.

The majority of the CRE loan portfolio currently on the market consists of multifamily properties, primarily located in the vibrant heart of New York City. Notably, a substantial portion of these CRE loans, approximately $15 billion worth, is secured by rent-stabilized or rent-controlled multifamily residences. Recognizing its statutory obligation, which includes the imperative to maximize the preservation of the availability and affordability of residential real property for low- and moderate-income individuals, the FDIC has unveiled a strategic plan.

To fulfill this commitment, the FDIC intends to establish one or more joint ventures (JVs) for the rent-stabilized or rent-controlled loans. In this arrangement, the FDIC will retain a majority equity interest in the JV. Additionally, the JV operating agreement will incorporate specific requirements aimed at ensuring the financial and physical preservation of these loans and their underlying collateral.

While the FDIC will maintain a majority equity stake in these JVs, the role of managing member will be assumed by the successful bidders or partners. This responsibility includes overseeing the management, servicing, and eventual disposition of the loans. The JV partner will be bound by the provisions of the JV operating agreement, subject to rigorous monitoring to guarantee compliance.

What’s on the menu?

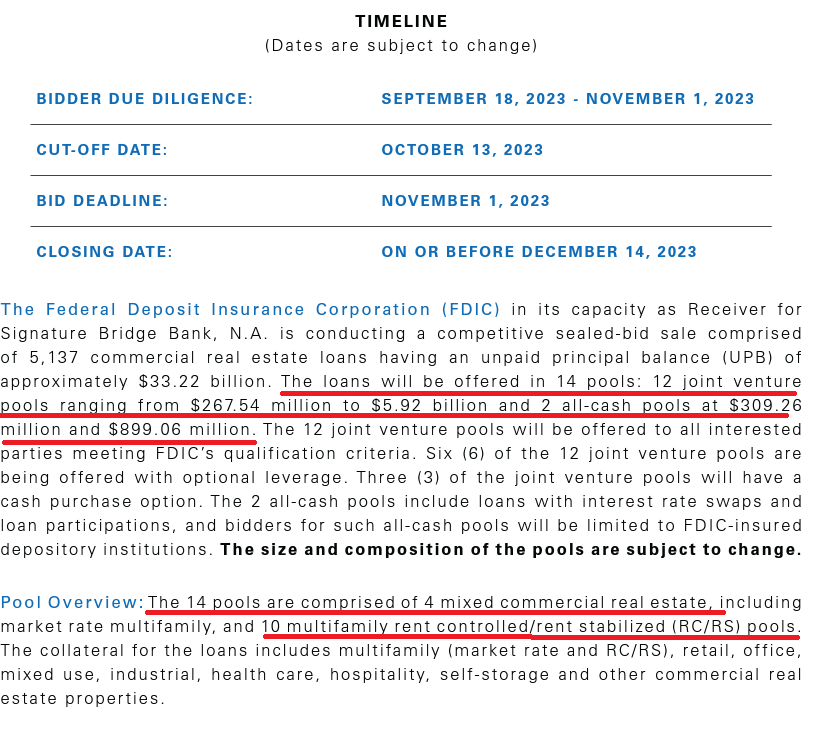

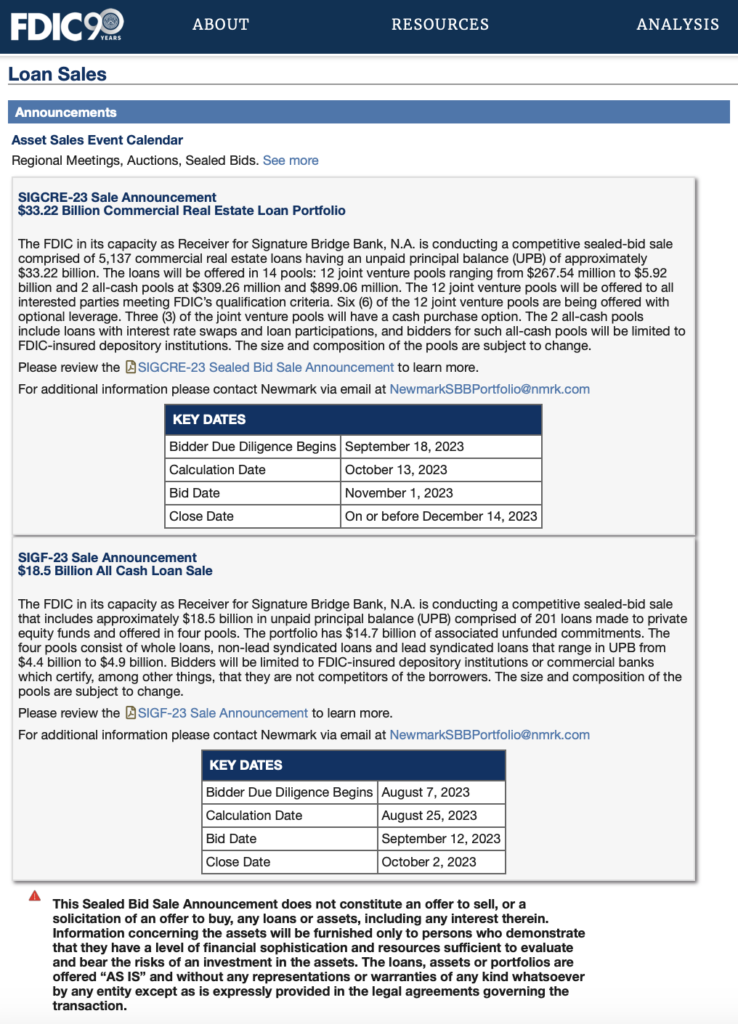

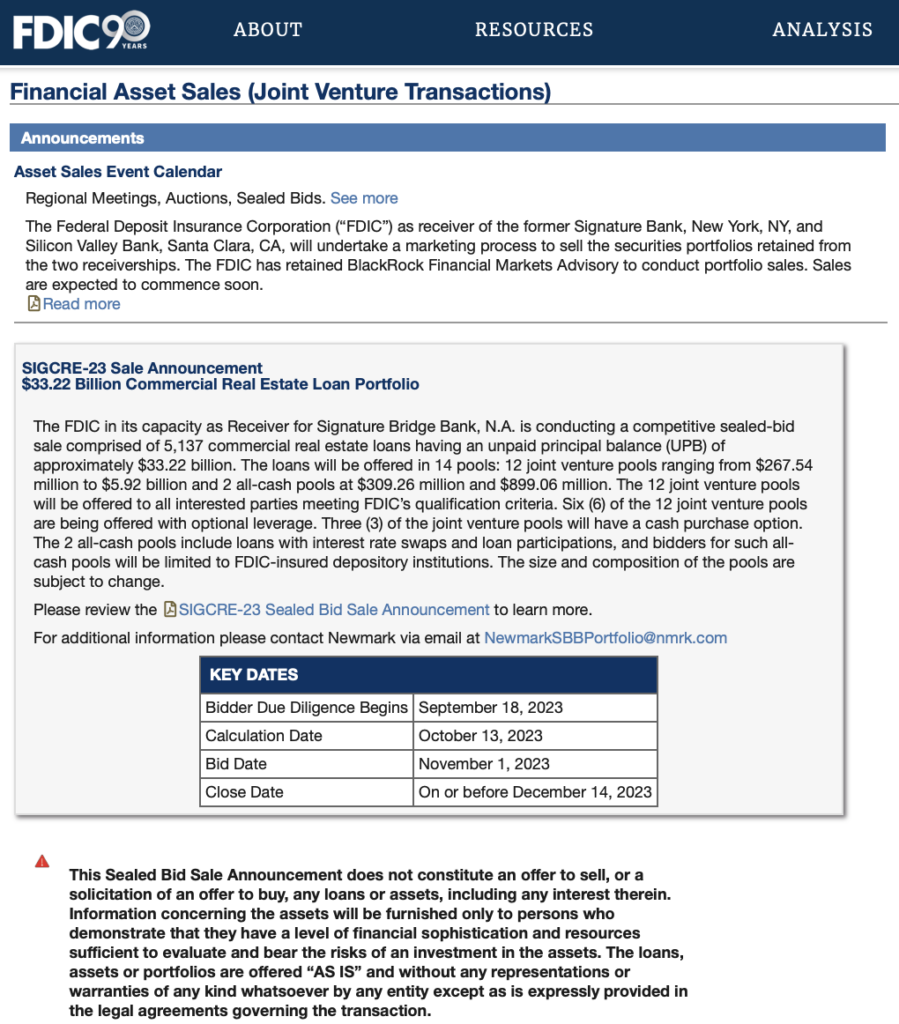

The FDIC, acting as the receiver for Signature Bank, is currently overseeing a competitive sealed-bid sale that encompasses a total of 5,137 commercial real estate loans, with an outstanding principal balance of approximately $33.22 billion. These loans will be made available through the creation of 14 distinct pools: 12 of these will be structured as JVs, with values ranging from $267.54 million to $5.92 billion, and the remaining 2 will be all-cash pools, each with values of $309.26 million and $899.06 million.

For the 12 JV pools, participation will be open to all interested parties who meet the FDIC’s qualification criteria. Notably, six out of these 12 pools will offer optional leverage to prospective participants, providing them with added financial flexibility. Furthermore, three of the joint venture pools will offer a cash purchase option for those preferring this method.

In contrast, the two all-cash pools encompass loans that include interest rate swaps and loan participations. Bidders aiming to acquire these all-cash pools will be restricted to FDIC-insured depository institutions as eligible participants.

It’s noteworthy that for this particular subset of the portfolio, the FDIC has been in close collaboration with various stakeholders, including New York City and New York State housing authorities and government agencies, as well as community-based organizations. This engagement has enabled the FDIC to gather valuable input and disseminate information about its marketing and disposition strategy.

The marketing phase for the former Signature Bank’s CRE portfolio is set to unfold over the next three months, with transactions expected to conclude by the end of 2023. To facilitate this process, the FDIC has enlisted the expertise of Newmark & Company Real Estate as an advisor on this sale.

In May, the FDIC released a report on Signature Bank, characterizing the firm with “poor management” and “did not always heed FDIC examiner concerns, and was not always responsive or timely in addressing FDIC supervisory recommendations.”

Signature Bank had $110 billion in assets at the end of 2022, ranking it as the 29th largest bank in the United States. According to FDIC quarterly banking data, the bank was overly reliant on uninsured deposits, which accounted for 90% of total deposits by the end of 2022.

Information for this briefing was found via FDIC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.