FULL DISCLOSURE: This is sponsored content for First Majestic Silver Corp.

Silver prices have spiked significantly in October, climbing nearly 8% this month to exceed $33.60 per ounce, leaving some of the largest U.S. banks with potentially substantial losses tied to their short positions on the precious metal. This sudden increase has triggered concerns within the financial sector about potential repercussions for both the banking system and industries reliant on stable silver prices.

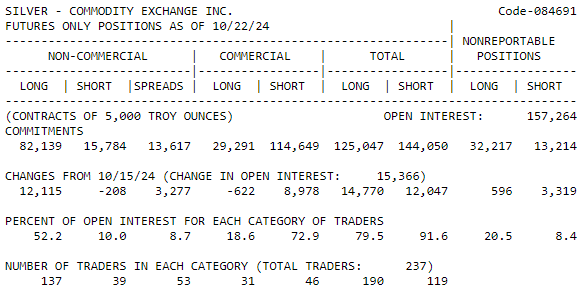

The price surge, which has pushed silver prices past their highest levels in over a year, has been driven by a combination of high demand in industrial sectors and investor speculation. As per The Silver Academy, data from the Commodities Futures Trading Commission reveals that open interest in silver futures now totals 157,264 contracts, each of which represents 5,000 ounces of silver. This equates to approximately 786.3 million ounces, a figure close to a full year’s global silver production.

Analysts have noted that this volume of trading in silver futures represents a massive financial commitment, with prices rising $1.84 per ounce over recent days. As a result, the short positions held by five major banks are now collectively facing an estimated $1.3 billion in losses.

Ole Hansen, Head of Commodity Strategy at Saxo Bank A/S, commented on the surge, noting, “Silver is viewed as the relatively cheap sibling to gold, and as gold continues to reach fresh record highs and copper hits a 2 1/2 month high, traders took it through resistance at $32.50.”

The rising interest in silver has been paralleled by high demand for other precious metals, as investors seek stable assets amidst economic uncertainty.

The report from The Silver Academy, which has been following silver’s market trends, emphasizes that the concentration of short positions among only five major U.S. banks poses a unique threat to market stability.

“This behavior undermines market integrity and could have far-reaching consequences for both the financial sector and industries that depend on stable silver prices,” said a representative from The Silver Academy.

Critics argue that the heavy short-selling activity conducted by these banks has contributed to an artificial depressions in silver’s value, masking strong demand from industries like electric vehicles, renewable energy, and electronics manufacturing. While these banks use short positions as a hedging strategy to manage the risk of price declines in commodities, the scale of the bets has led to an imbalance, with potentially far-reaching impacts if prices continue their upward trajectory. To cover these positions, banks may be forced to buy back silver at higher market prices, intensifying their financial losses.

First Majestic launches its own silver mint

As banks and industries grapple with the effects of silver’s price volatility, First Majestic (TSX: AG) (NYSE: AG) recently launched its own silver mint operation, with the mint officially being inaugurated on September 26. The company’s entry into the minting business is aimed at providing a direct avenue for investors and clients to acquire finished bullion products, with the bullion products manufactured from its own mined silver produced at its Mexican operations.

This new minting facility, designed as a means for investors to bypass traditional financial institutions, offers a streamlined option for those seeking direct ownership of silver. The initiative also represents a broader trend of companies in the silver sector seeking alternative distribution channels, which could help mitigate some of the market volatility driven by large-scale short-selling activities.

First Majestic’s mint comes at a time when traditional banks face mounting challenges in the silver market. By enabling more direct access to silver, the mint could reduce reliance on the futures market and alleviate some of the pressure caused by banks, potentially stabilizing the market for both investors and industrial users.

FULL DISCLOSURE: First Majestic Silver Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover First Majestic Silver Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

5 Responses

Silver’s spike is a wake-up call—banks’ big shorts just got way shorter!

Looks like silver’s outshining their usual playbook.

burn the shorts!

good! hope the banks lose even more than that!

Absolutely. These banks have been manipulating the silver market long enough. It’s time they got a taste of their own medicine. You know where sympathy is in the dictionary.