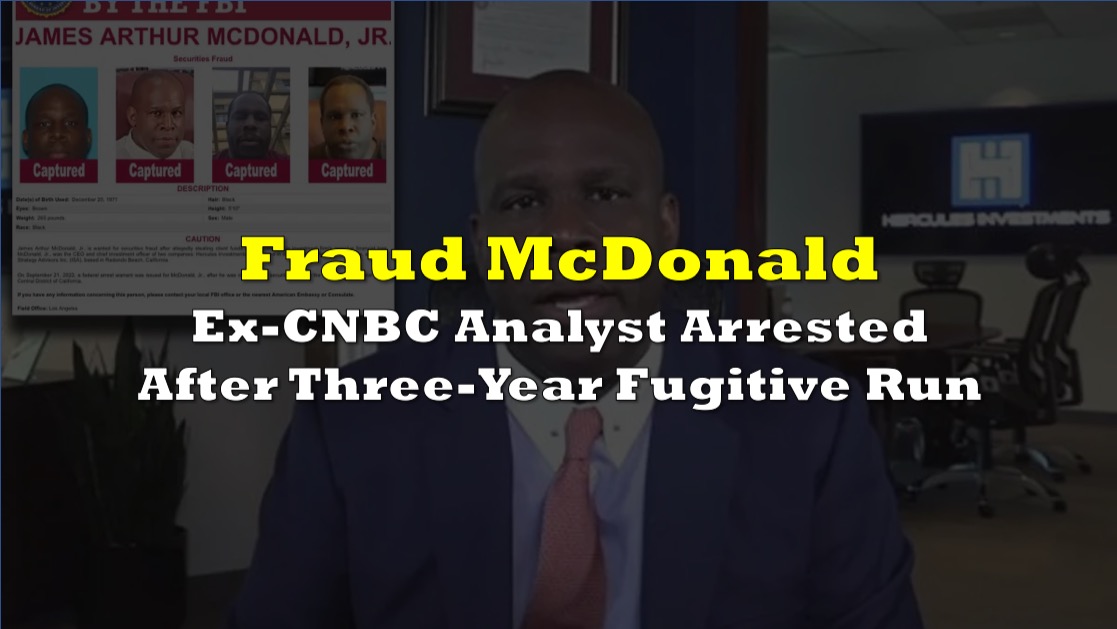

After more than two years on the run, former investment company CEO and TV financial analyst James Arthur McDonald Jr. was arrested last weekend and is facing federal fraud charges in Los Angeles. McDonald, who frequently appeared as a guest analyst on CNBC, is accused of defrauding investors out of millions of dollars, with significant funds misappropriated for personal expenses, including nearly $175,000 spent at a Porsche dealership, according to charging documents filed last year in U.S. District Court.

Former @CNBC Financial Analyst James Arthur McDonald Jr. captured after 2 years on the run pic.twitter.com/LxU4G2i9F9

— GuruLeaks (@Guruleaks1) June 23, 2024

McDonald, the former CEO of Hercules Investments LLC and Index Strategy Advisors, has been under investigation for multiple financial crimes. The charges against him include securities fraud, wire fraud, investment adviser fraud, and engaging in monetary transactions with criminally derived property.

Fraud McDonald

Court documents reveal that McDonald misled investors by lying about his educational background and the use of their investments. Despite his claims of holding an economics degree from Harvard University, McDonald is actually a graduate of the Harvard Extension School, an open-enrollment institution, where he took only one class related to economics.

McDonald also lost between $30 million and $40 million after taking a risky short position betting against the U.S. economy in the wake of the 2020 presidential election. To cover these losses and avoid disclosing them, McDonald allegedly raised more money by selling equity in his company and disguising how the proceeds would be used.

Prosecutors detailed that McDonald misappropriated at least $675,000 from investors. A significant portion of these funds was spent at a Porsche dealership. He solicited investments by offering to sell equity in Hercules Investments, falsely claiming that the funds would be used to expand the company’s infrastructure and staff. Instead, he used the funds to repay clients and finance his own lifestyle.

McDonald’s fraudulent activities were not limited to Hercules Investments. He also deceived clients of Index Strategy Advisors by falsely representing that their funds would be used for trading securities. Instead, he used less than half of the raised funds for trading, with substantial amounts diverted to personal expenses and paying off other investors to create the false impression of a successful firm.

The indictment against McDonald includes multiple counts, such as securities fraud, wire fraud, and investment adviser fraud. If convicted, he faces significant prison time and substantial financial penalties. The United States government is seeking forfeiture of all proceeds derived from McDonald’s fraudulent activities, including any property traceable to the offenses. In addition, substitute property will be sought if the proceeds from the fraudulent activities cannot be located or have been transferred or diminished in value.

On the run

McDonald has been considered a fugitive since November 2021, when he failed to appear before the U.S. Securities and Exchange Commission (SEC) to face allegations of defrauding investors. According to a criminal complaint, McDonald informed a former romantic partner and business associate that he was going to “vanish” after the SEC subpoenaed him for testimony.

He was finally located and arrested this month at a residence in Port Orchard, Washington.

Following his arrest, McDonald appeared in court on June 17 and waived his right to a detention hearing in the Western District of Washington. He remains jailed pending his transfer to Los Angeles, where he will face the federal charges.

McDonald was a well-known figure in the financial industry, particularly through his frequent appearances as a guest analyst on CNBC. His insights and analysis on market trends and investment strategies were regularly featured on the network, where he built a reputation as a knowledgeable and credible financial expert.

Information for this briefing was found via LA Times and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.