Freeman Gold (TSXV: FMAN) has seen its mineral resource estimate for its flagship Lemhi Gold Deposit in Idaho increase after further exploration.

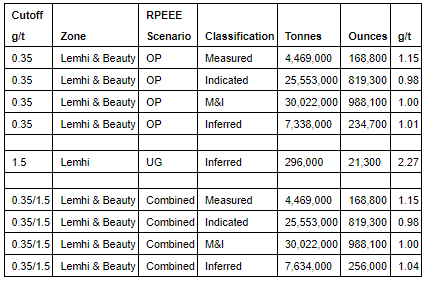

Measured and indicated ounces increased by 32% to 988,100 ounces of gold at a grade of 1.00 g/t gold, which is contained in 30.02 million tonnes. Inferred resources meanwhile totaled 234,700 ounces of gold in 7.34 million tonnes, at a grade of 1.01 g/t gold. The estimate is largely based on an open-pit mine model, with 21,300 ounces of inferred gold attributed to an underground model at Lemhi.

The estimate is based on a 0.35 g/t gold cut-off, and a gold price of US$1750 per ounce.

The update is based on 81,497 metres of drilling in aggregate, conducted between 1983 and 2022 via a total of 442 drill holes. The increase in ounces over previous estimates has been attributed to further infill drilling, and expansion of the deposit in all directions, including the addition of the Beauty Zone.

“Our new MRE for Lemhi firmly establishes this Project as one of the few remaining large, high-grade oxide gold deposits in the USA. We have successfully increased the size of the deposit by 24% while maintaining an approximate 1 g/t Au average grade. In addition to the increased size, we have continued de-risking the deposit by substantially improving the resource category with almost 1 million ounces in the Measured and Indicated category,” commented Executive Chairman Paul Matysek.

Freeman Gold last traded at $0.24 on the TSX Venture.

Information for this briefing was found via Sedar and Freeman Gold. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.