Evidently, the management team over at FSD Pharma (CSE: HUGE) (NASDAQ: HUGE) thinks its doing a great job. On Monday, the company filed a notice of issuance of listed securities form with the Canadian Securities Exchange, indicating $5.2 million worth of shares had been issued by the company. The kicker, is that the issuance was directly to the firms executive team.

The notice of the share issuance was discreetly listed at the bottom of a July 31, 2020 news released filed by the company, in connection with a US $10 million registered direct offering. At the time, 1,322,927 Class B common shares of the issuer were to be issued to its directors and management team as compensation. That figure however climbed to 1,692,182 Class B common shares by the date of issuance – growing the firms share count by 15.7% in the process.

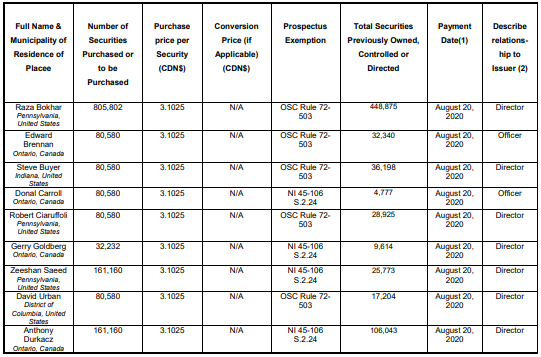

The largest distribution went to the firms CEO, Raza Bokhari, whom received 805,802 shares in total, or roughly half of the issuance, at a deemed price of $3.1025, the equivalent of $2.5 million. Issuance’s to other members of management was rather sporadic, with some directors and executives not receiving any shares at all.

Each of Edward Brennan, Steve Buyer, Donal Carroll, Robert Claruffoli and David Urban received 80,580 shares in the issuance, while Zeeshan Saeed and Anthony Durkacz received 161,160 shares. Director Gerry Goldberg received the smallest issuance, at 32,232 shares.

Statements made in connection with the filings make it unclear whether the issuance of common shares was in lieu of cash compensation, or if it was viewed as being a bonus.

FSD Pharma last traded at $3.76 on the CSE.

Information for this briefing was found via Sedar, and FSD Pharma. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Hard to talk when stock price is low correct me if I’m wrong but the latest payout as some of you are talking about here is my hypothesis

;

the cost of those shares that they cannot sell in canada is a cash tax cost out of their own pocket at 52 percent of the value.

So the compensation form is 48 percent, Anthony for example Still does not take any salary or compensation from the company for 2.5 years until and if the share price goes down all of the insiders will end up losing money not only us.

Here is the kick to this

It’s not like a cash bonus or compensation. It’s an investment and high risk and cash out of all of their own pockets to pay taxes that’s the way I see it if that makes sense ?

So it can look bad but really it’s not without a lot of risk on insiders to deliver their promise of bringing real shareholder value.

Also supposedly they can’t sell their shares for 4 months. If the shares go down 50 percent and they wanted to sell , the Insiders would be losing money. On top of that we can see when they buy or sell and how much.

Basically although I averaged down 3 time’s now each time it went lower they have the risk of losing their shares in a similar like us if it does not go the other way one day …

I’m not defending FSD just trying to explain the situation.

I could be wrong do what you feel is right. I averaged down 3 times and it went lower each time so I’m not a genius clearly.

Like Brookline capital said only 20% chance of success but if they are able to prove it works then who knows what can happen. I know they could apply for multiple IND’s afterwards if they wanted to for other illnesses.

Cheers

What are your thoughts on FSD Pharma now Dave?