It turns out that some FTX creditors are unhappy with claims that they are being “repaid in full” by the failed crypto exchange, and have instead resorted to filing a lawsuit against FTX.

As it turns out, creditors are being repaid in US dollar equivalents, rather than through the receipt of the crypto they had stored. What’s more, repayment is to be based on the price of crypto at the time of the bankruptcy filing. Conveniently for FTX, the price of bitcoin has rallied dramatically since the exchange went bankrupt. In a nut shell, this means bitcoin holders will receive $16,871 in cash for their bitcoin – not the current price that it is trading at of $43,052 per bitcoin.

READ: FTX Anticipates Full Repayment to Crypto Customers Amid Bankruptcy Proceedings

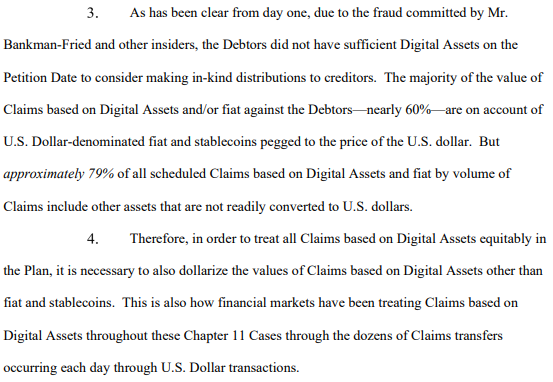

FTX however argues that the need to settle in dollars is a requirement – citing that the debtors did not have sufficient digital assets as of the petition date to even consider in-kind distribution to creditors. And with roughly 60% of the claims for digital assets denoted in US Dollars, in order to treat all claims equally, it means that FTX has to dollarize the claims that are based on digital assets.

And unfortunately for those that held digital assets on the exchange, losses are based on the petition time under bankruptcy code – meaning the time at which the company filed for bankruptcy.

But there might be a chance just yet. Creditors are claiming that the digital assets amount to creditor property rather than property of FTX – which if successful, means creditors have a chance to be paid in full based on the current crypto prices. The Delaware court however must yet determine who actually owns the digital assets.

The problem however, remains to be that FTX simply doesn’t own the digital assets it needs to make creditors whole, resulting in the same end result – or worse.

Information for this briefing was found via Coindesk and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.