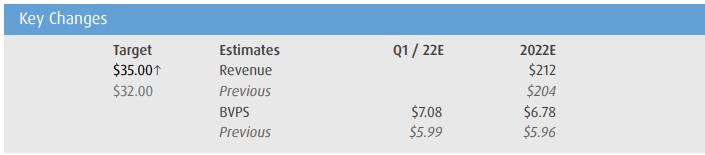

On April 3rd, BMO raised Galaxy Digital Holdings’ (TSX: GLXY) 12-month price target from $32 to $35 and reiterated their outperform rating after they released their fourth quarter and full-year financial results.

Currently, there are only 3 analysts covering Galaxy Digital, with an average 12-month price target of $36, which represents an 83% upside to the current stock price. Out of the 3 analysts, 1 has a strong buy rating, 1 analyst has a buy rating and the last analyst has a hold rating on the name. The street high comes from BTIG with a $48 12-month price target, or a 145% upside from here.

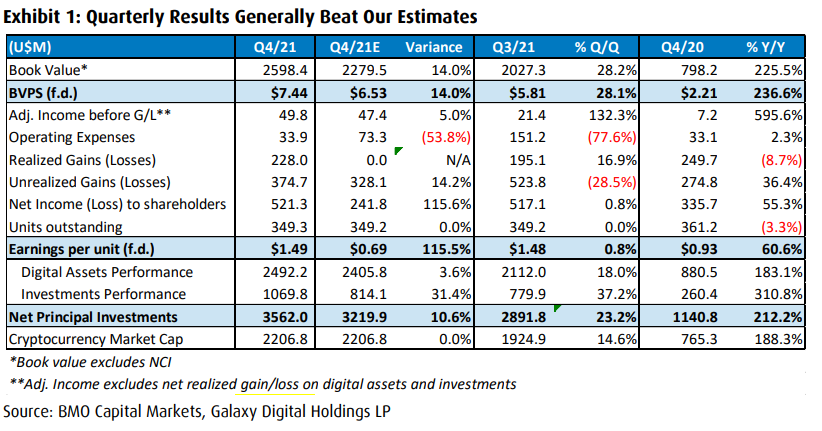

On the results, BMO says that they continue to be pleased with “high growth in the operating business, stronger trading performance relative to the market, and continued upside from private investments.”

BMO says that the quarter was driven by a 15% quarter-over-quarter increase in the broad cryptocurrency market cap to $2.2 trillion, while Galaxy saw its private investments have a strong quarter, being marked up 37% quarter over quarter. This is thanks to its investments in Fireblocks Ltd., Block.one, and Candy Digital Inc.

Additionally, BMO notes that the company’s book value grew faster than the market. Galaxy’s book value grew 28% quarter over quarter to $2.6 billion, while the market grew 15%.

Another point BMO highlights in their note, is that the U.S uplisting uncertainty increases, as the company delayed its timing for a second time now. Though management has said the delay is partly due to the SEC’s thoroughness and the application of GAAP accounting to the company.

Management suggested “that the way the rules are applied under GAAP results in financial statements that do not intuitively reflect the underlying economics of the business, and believes that ultimately the accounting

rules will have to be revised.”

Lastly, BMO says that the extension and new terms for the BitGo acquisition reflect “continued valuation strength in private markets.” They believe that the extension is a positive as there is uncertainty from the SEC in their review process. They write, “We continue to believe the transaction makes strategic sense for both companies and expect shareholder approval, although the transaction remains conditional on Galaxy successfully redomiciling to the U.S.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.