After the regular market close on December 7, GameStop Corp. (NYSE: GME) reported a second successive quarter in which its revenue declined versus the year-ago period. The company’s sales in 3Q FY 2023 ended October 29, 2022 were US$1.19 billion, down 8.5% from US$1.3 billion in 3Q FY 2022. GameStop reported an adjusted diluted EPS loss in 3Q FY23 of US$0.31, a modest improvement from a loss of US$0.35 in the year-ago period.

GameStop’s quarterly sales declined even more than the 5% decline in the overall U.S. video game industry, as measured by The NPG Group, an industry research firm. This quarter was the first quarter this year that GameStop’s sales change trailed the industry average.

| Total Consumer Spending on Video Gaming in the U.S. | Video Gaming Industry Year-Over-Year % Change | GameStop Year-Over-Year % Change in Revenue (A) | |

| 3Q 2022 | $12.34 billion | -5% | -8.5% |

| 2Q 2022 | $12.35 billion | -13% | -4.0% |

| 1Q 2022 | $13.90 billion | -8% | 8.0% |

Sources: The NPD Group and GameStop.

GameStop’s adjusted EBITDA improved marginally in 3Q FY 23 to a loss of US$66.6 million from negative US$78.1 million sequentially, and from negative US$79.8 million in the year-ago quarter. However, its adjusted EBITDA for the twelve months ended October 29, 2022 remains decidedly negative (US$397 million), as it has been for quite some time. GameStop last reported a quarter with positive adjusted EBITDA in the period ended January 2021 (positive US$51 million).

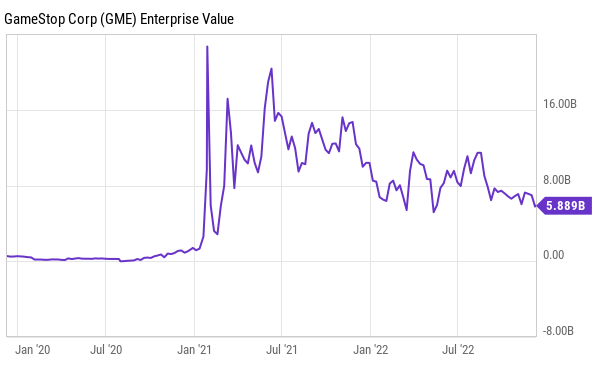

As such, GameStop’s valuation continues to be detached from reality. Its enterprise value is approximately US$6.3 billion despite its continued cash flow deficits. Equally important, there is no indication this key measure will turn higher, nor does management present any forward estimates of any kind for the company.

| GAMESTOP CORP. | |||||

| 3Q FY23 | 2Q FY23 | 1Q FY23 | 4Q FY22 | ||

| Twelve Months Ended Oct. 29, 2022 | Oct. 2022 | Jul. 2022 | Apr. 2022 | Jan. 2022 | |

| Revenue | $5,954.7 | $1,186.4 | $1,136.0 | $1,378.4 | $2,253.9 |

| Adjusted EBITDA | ($397.1) | ($66.6) | ($78.1) | ($125.5) | ($126.9) |

| Adjusted Operating Income | ($515.6) | ($95.0) | ($106.2) | ($153.7) | ($160.7) |

| Adjusted Diluted EPS | ($1.65) | ($0.31) | ($0.35) | ($0.52) | ($0.47) |

| Operating Cash Flow | ($340.3) | $177.3 | ($103.4) | ($303.9) | ($110.3) |

| Cash – Period End | $1,042.1 | $1,042.1 | $908.9 | $1,035.0 | $1,271.4 |

| Debt – Period End | $574.5 | $574.5 | $602.4 | $617.0 | $649.0 |

| Fully Diluted Shares Outstanding (Millions) | 304.2 | 304.2 | 304.0 | 303.6 | 303.6 |

| Fiscal year 2023 ends January 31, 2023. |

GameStop did not address any job cuts in its 3Q FY2023 earnings release. Several media sources reported earlier this week that the company had implemented another round of layoffs, including in its blockchain team (see below).

In May 2022, GameStop announced the launch of cryptocurrency and non-fungible token (NFT) businesses. Furthermore, it established an NFT marketplace where participants could transact. None of these efforts have gained traction. The 3Q FY23 10-Q says that “revenues earned from our digital asset wallet and NFT marketplace were not material to the condensed consolidated financial statements for the three and nine months ended October 29, 2022.” GameStop’s second quarter 10-Q contained the same language, only with a different end date, July 30, 2022.

Back in September 2022, GameStop announced a partnership with FTX US that would introduce GameStop’s customers to FTX’s marketplaces. GameStop would apparently sell FTX gift cards in some of its stores. No mention of that initiative was made in its earnings release or current 10-Q.

GameStop continues to look overvalued. It is now trading at its lowest point, US$22.26, since late May. It should be noted, however, that the stock bounced fairly aggressively off the US$20 level twice this year, both in mid-March and mid-May.

GameStop Corp. last traded at US$22.26 on the NYSE.

Information for this briefing was found via Axios, LinkedIn, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The desperation is palpable