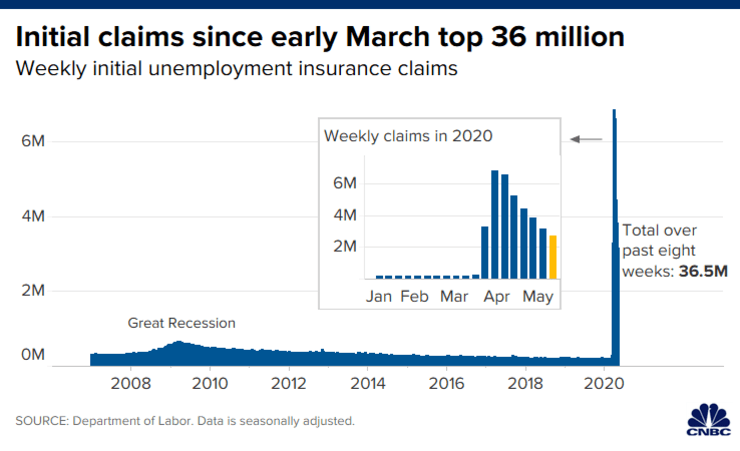

Since the beginning of the coronavirus pandemic in the US, more than 36.5 million Americans have found themselves unemployed, and at the mercy of employment benefit providers as well as the federal government. Many of those newly unemployed workers previously held jobs in non-essential sectors such as hospitality and restaurant services, and were taking home a minimum wage of $13.45 per hour. But now, it seems that some of those workers are getting paid more to sit on their couch at home than they were when they were working.

As a means of mitigating the detrimental economic setbacks caused by the coronavirus, the federal government allocated an additional $600 to go on top of employment benefits for American workers who found themselves without a job. But it turns out, such a “generous” handout may be deincentivizing many of those workers to return to their poorly paid jobs. A recent study conducted by economists at the University of Chicago found that approximately 68% of unemployed individuals are able to receive benefits which are greater in amount than what they were earning when they were employed.

Furthermore, the study also determined that the median replacement rate averaged approximately 134% – meaning that many unemployed workers are eligible to receive 34% more while on unemployment benefits compared to when they were working. So that begs the question, is anyone really going to be motivated enough to return to work once the economy reopens instead of binge-watching Netflix documentaries?

Let’s not be too condescending however. Due to the mass hardships unveiled by the pandemic, many companies have already had to shut their businesses down permanently, while those that are still in operation are doing so at a reduced workforce rate. This means that when the economy does reopen to non-essential services such as restaurants and hospitality services, many of those workers won’t have a job to return to – even if they are eager to get back to the workforce. And, with the $600 federal government bonus coming to an end in July, the free ride really wasn’t much of a free ride after all..

Information for this briefing was found via Zero Hedge, Bloomberg, and the Becker Friedman Institute. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.