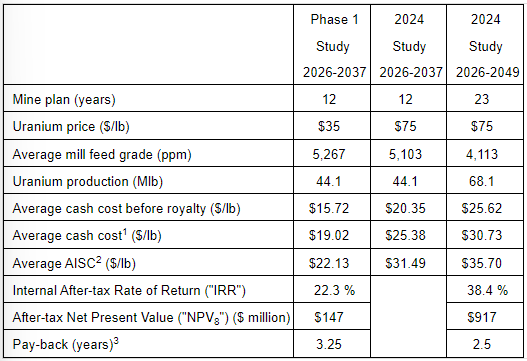

Global Atomic Corp (TSX: GLO) has released an updated feasibility study for its Dasa Project, which is located in Niger. The study has outlined an after-tax net present value (8%) of $917 million, which is based on $75 per pound uranium, a massive increase from the prior estimate of $147 million under the original feasibility study.

The estimate has jumped substantially as a result of increasing the life of mine from 12 years to that of 23, while the original feasibility study was also based on $35 per pound uranium. The new study estimates annual production of 68.1 million pounds of uranium per year, at an average cash cost of $30.73 a pound, and an all-in sustaining cost of $35.70 per pound.

“The 2024 Study has identified significant improvements in the Dasa Project from the Phase 1 Feasibility Study including a 50% increase in Mineable Reserves and a near doubling of the mine life. The payback period estimated in the 2024 Study is expected to be 2.5 years, including recovery of amounts already spent,” commented Stephen Roman, CEO of Global Atomic.

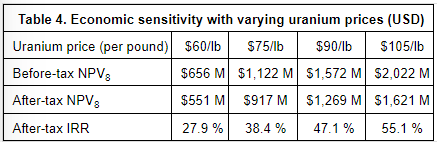

A sensitivity analysis meanwhile was provided for uranium pricing ranging from $60 per pound to $105 per pound.

Global Atomic meanwhile indicated this morning it has signed a letter of intent for an off-take agreement for the mine. The LOI outlines the supply of 260,000 pounds of uranium over a three year period, starting in 2026, with the uranium to be sold to a Europe-based nuclear power utility. The LOI is said to be priced to current term market prices, and is the fourth such off-take arrangement entered into, with the company having commitments for 9.5 million pounds U3O8.

Global Atomic last traded at $3.21 on the TSX.

Information for this story was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.