On September 1st, Gold Royalty Corp. (NYSE: GROY) announced that it has entered into an agreement with Nevada Gold to acquire three different royalties for total consideration of US$27.5 million, to be paid in the form of 9,393,681 shares. The company expects that the transaction will close by the end of the current quarter.

The first royalty is 10% Net Profits Interest on a Granite Creek mine operated by i-80 Gold Corp, payable after 120,000 ounces of gold is produced by the project. The second royalty is a 2% Net Smelter Return on a Bald Mountain Mine operated by Kinross Gold, which is payable after 10 million ounces of gold has been produced. The last is a 1.25% NSR on another Bald Mountain joint venture zone operated by Kinross.

Gold Royalty has five analysts covering the stock with an average 12-month price target of US$6.05, or an upside of 126%. Out of the five analysts, three have buy ratings, and the other two analysts have hold ratings on the stock. The street high price target sits at US$8.00, or an upside of almost 200%.

In BMO Capital Markets’ note on the news, they reiterate their market perform rating on the stock but cut their 12-month price target to US$4.75 from US$5.00, saying that ultimately they estimate that the transaction is dilutive to their net asset value of the company.

They note that they do not assign any “material value” to the Bald Mountain royalties. As a result, the company is paying 1.4x net asset value while the company’s spot net asset value is 0.8x.

As a result, BMO says that the main value driver comes from the 10% Net Profits Interest on the Granite Creek Mine, which has produced 7,000 ounces of gold so far. Though BMO writes, “operation delivering into production expectations remains to be seen.” The macro environment has changed since the prepared study was conducted on the mine.

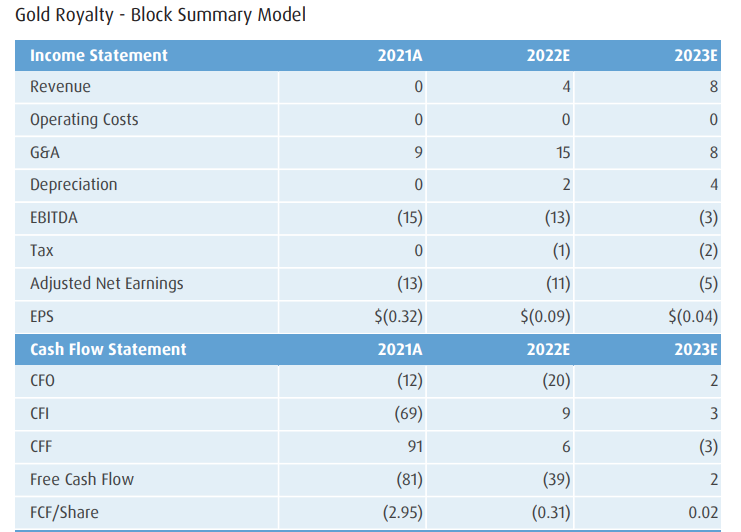

Below you can see BMO’s estimates on Gold Royalty.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Great resource. Thanks for sharing with us. I think Ripple XRP is the best token for investment for the long run.