Goldshore Resources (TSXV: GSHR) has utilized a different consulting firm to assemble a revised resource estimate for its Moss Gold and East Goldstream deposits. The change follows an embarrassing ordeal last year, when the company filed a technical report with the comment section still turned on in the PDF document, revealing some less than desirable commentary.

The latest resource estimate was prepared by APEX Geoscience, who used historical assays within the revised estimate, in conjunction with more recent exploration conducted. In total, 738 drill holes saw their data used for the resource estimate.

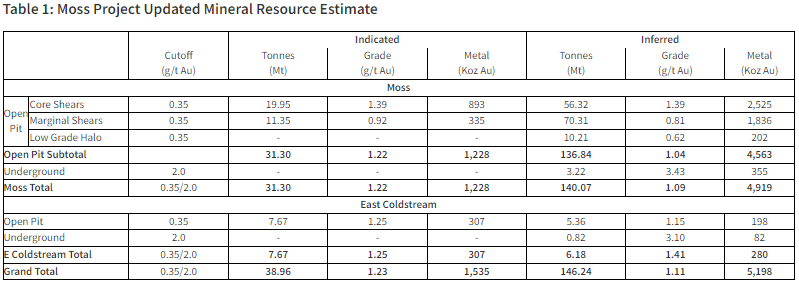

The revised estimate outlines an indicated resource of 1.53 million ounces of gold at 1.23 g/t, as well as inferred resources of 5.20 million ounces at 1.11 g/t gold. The estimate overall saw a tonnage increase of under 1% compared to the 2023 estimate, while grade improved by 11%.

“Conducting this update to the MRE was the logical next step in defining our strategy going forward of understanding and defining the potential of the Moss Gold Project; in an effort to maximize shareholder value. We continue to believe that the Moss Gold Project will be a sector anomaly of having top quartile grade and top quartile size and scale within our comparable peers; as it moves closer to being a Tier One asset,” commented Brett Richards, CEO of Goldshore.

In terms of future potential, the resource estimate is said to be modeled based on shear zones have a strike length of 5.7 kilometres, however historical drilling has identified a strike length in excess of 8.0 kilometres. Furthermore, the company has claimed that 4.0 million tonnes of gold mineralization exists within the current conceptual open pit, however drilling has been spaced too widely for this to be used within the inferred or indicated classification, which represents potential for further expansion.

Going forward, the company intends to continue to relog and resample historical drill holes where possible.

Goldshore Resources last traded at $0.09 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.