On August 3, Green Thumb Industries (CSE: GTII) reported its second quarter financial results. The company announced that revenue grew 5% sequentially and 15% yearly to $254.3 million. The company reported gross profits of $125.8 million or 49.5%, while profits were up notionally from $122.9 million, and margin was down from 55.4% last year. Selling, general, and administrative costs decreased to $63.5 million, or 25% of revenue.

Net income came in at $24.4 million, or earnings per share of $0.11, while cash flow from operations came in at roughly -$15 million, primarily related to the company paying its taxes during the second quarter.

The company ended the quarter with $145.3 million in cash and cash equivalents while having total debts of $253.4 million.

The company noted that retail revenue increased almost 12% quarter over quarter while same-store sales were down 1.5% yearly.

Green Thumb Industries currently has 18 analysts covering the stock with an average 12-month price target of C$35.34, or an upside of 185%. Five of the 18 analysts have strong buy ratings, while the other 13 have buy ratings. The street high price target sits at C$63, representing an upside of about 408%.

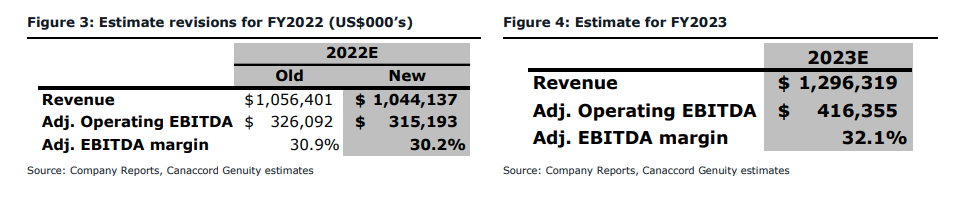

In Canaccord Genuity’s note on the results, they reiterate their buy rating on the stock but cut their 12-month price target from C$40 to C$35, saying that even though the results came in above consensus, “given continued inflationary headwinds on consumer spending habits, we have tapered down our overall growth expectations.”

On the results, Canaccord says that the company’s results came from execution in Illinois as the company continues to compete for a leading market position and the newly minted adult use sales from New Jersey. While on the near 12% uptick in retail sales, Canaccord says that this uptick was most likely seasonal but notes that the year-over-year decrease was likely due to inflation.

Below you can see Canaccord’s updated estimates.

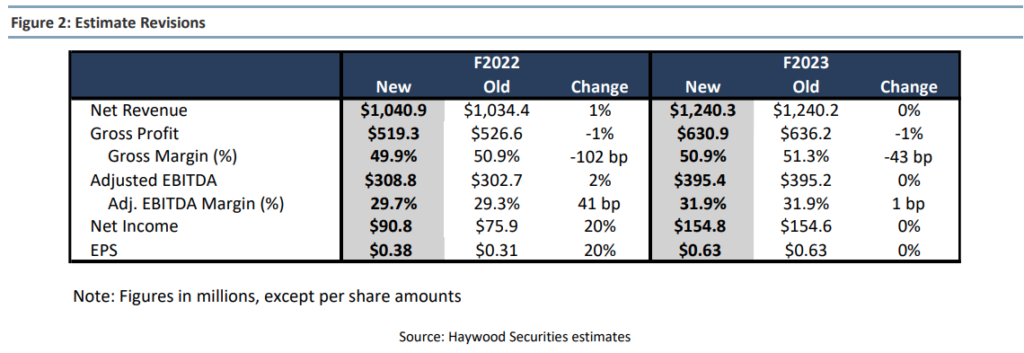

Onto Haywood Capital Markets, who reiterated their buy rating on Green Thumb while slashing their 12-month price target from C$36 to C$26. They commented that the price target slash comes, “in light of the continued multiple compression across the sector,” and believe that investors should have exposure to the company as it has a track record of beating analysts estimates for multiple quarters in a row.

On the results, Green Thumb beat all of Haywood’s estimates and says that the company benefitted from “being diversified across several markets as well as the start of adult-use sales in New Jersey.” The largest beat comes from Green Thumb’s bottom line, where Haywood expected the company to report $11.3 million in net income and $0.05 earnings per share, which Green Thumb beat by 119% and 126%, respectively.

The only metric to miss Haywood’s estimate was gross margins, as they were expecting the company to report 51% gross margins. They add that management noted that “certain cash costs” hit the company’s gross margins by 1.5%. This was ultimately offset by a lower SG&A and therefore had no impact on the company’s EBITDA.

Below you can see Haywood’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.