Earlier this week, Harvest Health & Recreation (CSE: HARV) released its third quarter results. The company reported revenues of $61.6 million, up 11% quarter over quarter, and adjusted EBITDA of $10.5 million, up from $4.1 million last quarter.

Canaccord’s cannabis analyst Matt Bottomley raised their 12-month price target from C$5.00 to C$6.00 and reiterated their speculative buy rating. He explains the rating change by stating, “on the back of the passing of AZ’s Proposition 207, we have increased the market opportunity in the state to US$2.2B (from ~US1.0B), while decreasing HARV’s assumed mature market share to 18% (down from 22%) to account for the risk of modest market share dilution upon adult-use implementation.”

He headlines, “Q3/20 review: Harvest kicks off MSO earnings season with a solid beat and bump to guidance.” Revenue was slightly above Canaccord’s $61.4 million estimate. Bottomley says that this growth was primarily due to strong organic growth in its core markets and the addition of two new retail stores.

Harvest’s adjusted EBITDA came in at 46.6%, up 450bps quarter over quarter. Their operating expenses decreased by 5%. Combining both, Harvest saw their adjusted EBITDA to grow to $10.5 million, above Canaccord’s $7.3 million estimate.

Bottomley notes that the guidance increase from $220 million to above $225 million implied only a 3% top-line growth but says management is being conservative with their full-year guidance.

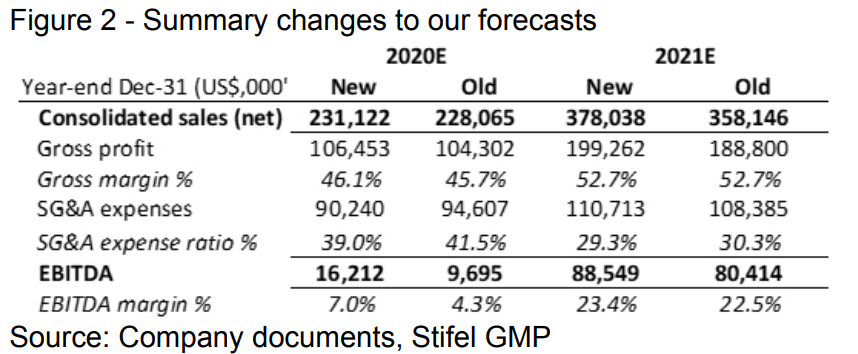

Stifel GMP also raised their 12-month price target from C$2.00 to C$3.50 and rating to buy from hold on the back of Harvest’s results. Andrew Partheniou, Stifel’s analyst, comments, “we raise our estimates largely due to Q3/20’s results flowing through future quarters, with AZ REC included in our valuation but not yet in our forecasts.”

He then goes onto say, “HARV positioning itself to avoid supply shortages in AZ.” Harvest is a net wholesale purchaser, which allowed them to have strong performing stores, coupled with the expected increase in demand in the recreational market. Harvest has been renegotiating its existing agreements to include a right of first refusal on wholesale purchases. Partheniou says, “Hence, the company seems well-positioned to avoid lost sales, and fully benefit from the coming REC market.”

Stifel GMP has changed their 2020 and 2021 forecasts for Harvest, which you can find below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

It seems to me you are understating 2021 estimated gross profits for this reason. While it is true labor costs will increase significantly due to the doubling of business as a result of legalization of Rec. There will not be an increase in the building of new facilities including grow facilities because Harvest has contracts with third party growers and will be using existing retail outlets. Thus the main expenses will be labor and product only with additional administrative personnel. Also the CEO on the conference call said he estimates annual sales of $216 M US once everything is up and running.