On January 20th, Well Health (TSX: WELL) provided a business update which included fourth quarter “guidance” as well as they announced that they will be resuming a normal course issuer bid. For the guidance, the company said that it expects to report quarterly revenues that puts the company’s annual revenue run-rate at over C$450 million and adjusted EBITDA of over C$100 million.

WELL Health currently has 13 analysts covering the stock with an average 12-month price target of C$11.46, or a 171% upside to the current stock price. Out of the 13 analysts, 3 have strong buy ratings and the other 10 have buy rating. The street high sits at C$14.25 which represents a 237% upside to the current stock price, while the lowest price target sits at C$9.

In Haywood Capital Markets’ note, they reiterate their buy rating and C$12 12-month price target saying that the company is tracking ahead of its previous revenue guidance. They add that the news release suggests that it’s sitting comfortably to deliver on it’s guidance with no additional acquisition support.

They add that the underlying business looks solid as well. Total omnichannel patient visits increased 19% quarter over quarter, which Haywood says, “suggests organic growth in the channel QoQ in addition to the big acquisitive YoY bump.” While the CRH business is reported to show US$43 million in “free cash flow” before taxes and interest for the fourth quarter.

Lastly, Haywood believes that the NCIB program is solid as they agree on the idea that the stock is a bargain at these prices. They also add that the major focus is still on acquisitive growth as the company has consolidated a number of companies in 2021. They believe the company continues to boast a strong balance sheet and a robust pipeline of targets.

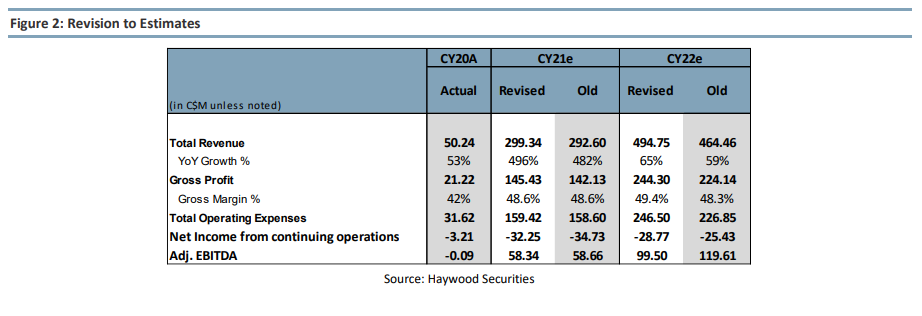

Below you can see Haywood’s updated full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.