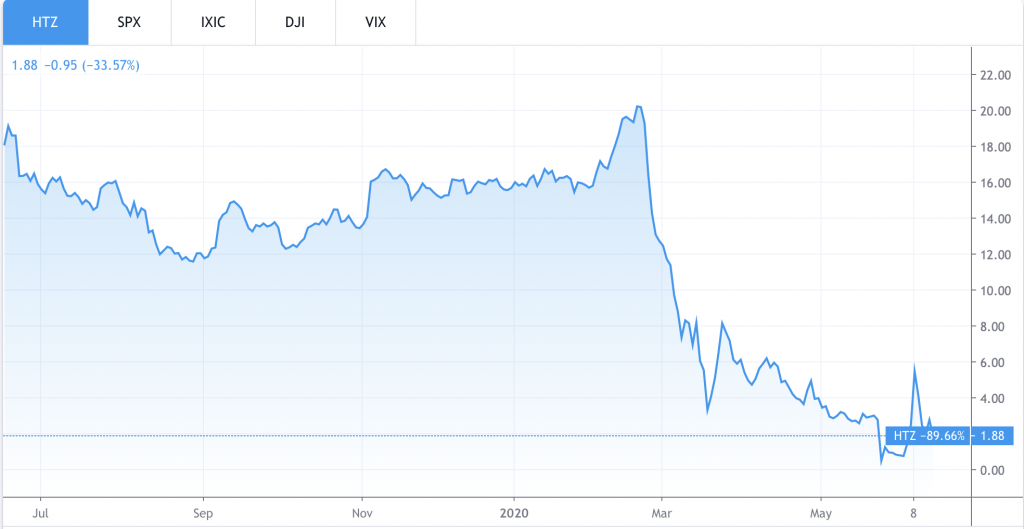

Once again, lets shine the spotlight on the infamously bankrupt car rental company Hertz Global (NYSE: HTZ). As postulated last week, it does in fact appear that all rationality has flown out the window, as a bankruptcy judge did in fact approve Hertz’s and Jefferies LLC’s equity offering, instead of sending it to paper shredder.

Given the Hertz stock buying frenzy among Robinhood day traders, the car rental company, along with Jefferies, decided to capitalize on the opportunity. The equity offering is so bizarre it belongs in an Alice in Wonderland plot, but apparently not irrational enough for Judge Mary Walrath, gave Hertz the go-ahead to issue up to $1 billion of new company shares as a means of raising cash.

In return for the judge’s approval, Hertz has been instructed to warn potential new stock investors of the obvious risk that exists when a company issues an equity offering amidst a bankruptcy. According to the mandatory warning, Herz reminded potential equity holders that they will most likely be wiped out by the time the bankruptcy filing is completed – some of which is completely new information to amateur Robinhood traders.

The new equity holders that do end up buying Hertz’s bankrupt stock can forget about receiving any sort of returns, given the company’s extensive debt collection. Even though the New York Stock Exchange has proceeded with delisting the company’s stock, Hertz has appealed decision and will in fact continue with the unprecedented equity offering.

Information for this briefing was found via Wall Street Journal. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.