Yesterday, Hexo Corp (TSX: HEXO) (NYSE: HEXO) released its fiscal first quarter 2021 financial results. They reported net revenue of $29.5 million, which is a 9% increase quarter over quarter. Hexo says that they maintained number one market share in Quebec, while Alberta’s gross sales increased by 18%. Ontario was 15%, and B.C was 6%

Hexo Corp currently has 13 analysts covering the company with a weighted 12-month price target of C$1.14. This is down from the average one month ago, which was C$1.47. One analyst has a buy rating, while the bulk, nine analysts, have hold ratings. One analyst has a sell rating, and two have strong sell ratings.

Below you can see the latest analyst changes:

- Canaccord Genuity raises target price to C$1.25 from C$1

- ATB Capital Markets raises to sector perform from underperform

- ATB Capital Markets raises target price to C$1.20 from C$0.85

- MKM Partners raises fair value to C$1.30 from C$1

As indicated above, Canaccord Genuity raised their 12-month price target to C$1.25 from C$1 while maintaining their hold rating on the stock. Matt Bottomley headlines the note with, “FQ1/21 review: Modest improvements as HEXO looks to better align ops with current market conditions.”

Bottomley starts the note by saying that the results were generally in line with their expectations, but “highlight what appears to still be a challenged macro environment for many Licensed Producers (LPs) in the space.” He believes that although the retail numbers in Canada remain strong with a +$3 billion run rate, the highly competitive landscape for cannabis producers has resulted in an oversupply of infrastructure and inventory.

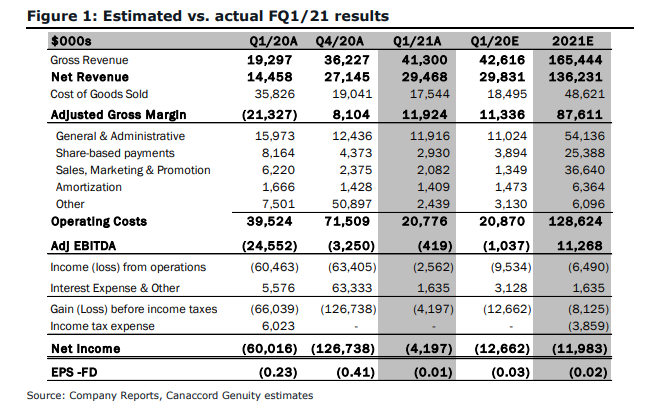

Below you can see Canaccord’s estimates versus Hexo’s first quarter results.

As there was not much variance between Canaccord’s estimates and the actual numbers, Bottomley did not talk much about the earnings but rather a few key performance indicators that he outlines. The first being that HEXO continues to maintain its #1 position in Quebec. Quebec currently has a run rate of C$540 million, and HEXO now has a 29% market share.

Bottomley says the second key performance indicator is that HEXO is currently the #4 LP for net sales nationally. HEXO is behind Aphria, Canopy, and Aurora for net adult-use sales. He also mentions that they have a #1 market share for hash, with HEXO being the first company to enter the space. Bottomley calls the hash segment a high performer segment.

The last indicator Bottomley writes about is that the collaboration with Molson Coors, HEXO’s Truss joint venture, has achieved a #1 market share in the beverage segment in only three months.

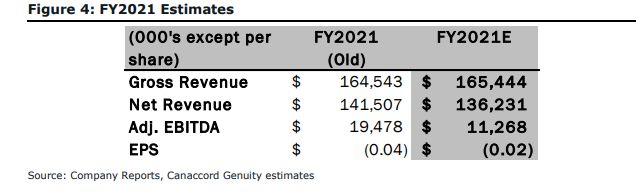

Bottomley touches slightly on HEXO’s balance sheet. He writes that with roughly C$150 million of cash on hand, “should HEXO meet its profitability timing target (adj. EBITDA positive next quarter), we believe the risk of near-term dilution is relatively low at this time.”

Finally, Bottomley adds that this quarter represented a step in the right direction after last quarter’s material write-offs and dilutive financing. HEXO now has a cleaner balance sheet, and “we believe HEXO is making strides to better right-size its operations with current market conditions.”

Below you can see Canaccord’s new 2021 full-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.