Hypercharge Networks Corp. (NEO: HC) has unveiled its unaudited financial results for the three months ending June 30, 2023. The firm reported a quarterly revenue of $0.5 million, marking a 628% increase compared to the same period in the prior year, when revenue was at $0.07 million for the three months ending May 31, 2022. This surge in revenue underscores the company’s accelerating market presence and the heightened demand for its cutting-edge EV charging solutions.

“We are pleased to report the unaudited financial results for the three months ended June 30, 2023,” said David Bibby, CEO of Hypercharge. “We are proud to see the increase in our customer base and their growing confidence in our ability to provide innovative charging solutions reflected in these results.”

The firm was also able to improve its margins, with gross margin ending at 46% compared to a gross loss of around 2% last year. But an 86% increase in operating expenses brought the company’s bottom-line down and comparable to last year.

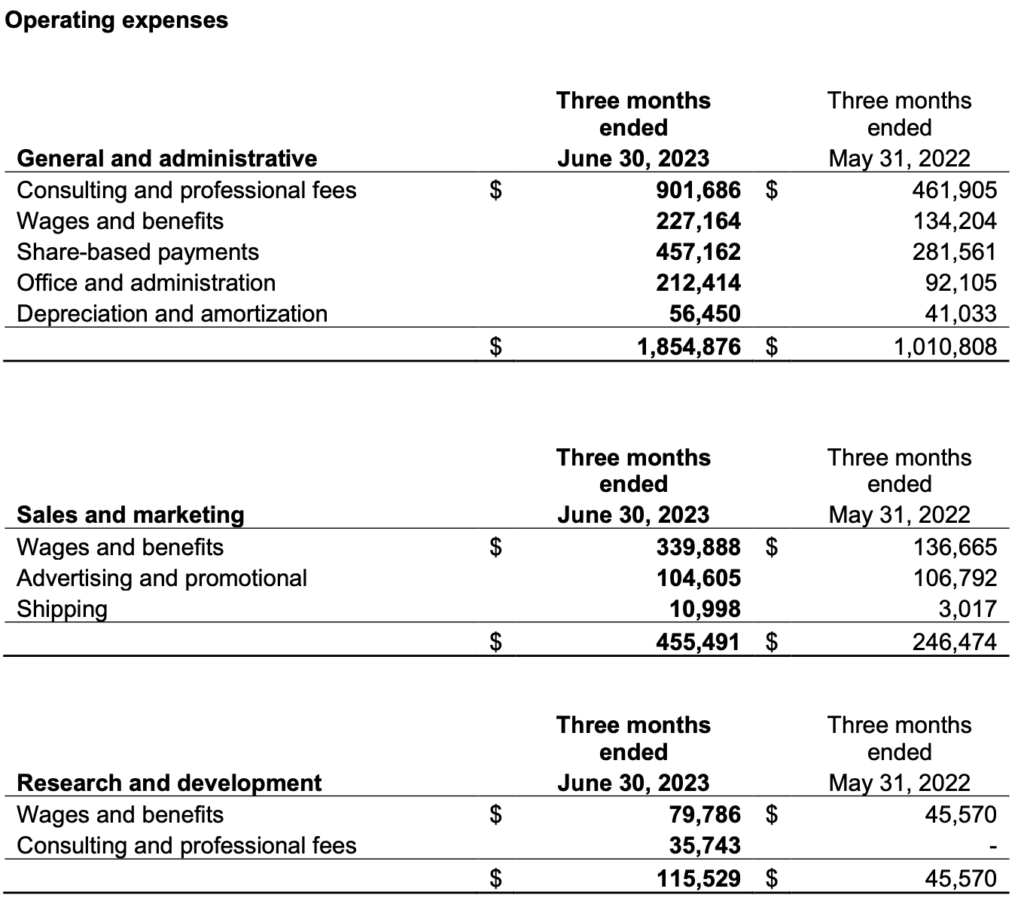

Operating expenses rose from $1.3 million in the comparative period last year to $2.4 million for the second quarter this year. The rise in operating expenses is primarily attributed to general and administrative costs related to non-cash share-based compensation expenses and one-time expenditures. Conversely, the lower operating expenses during the same period last year were reflective of the company’s early business stages, which translated into reduced direct and variable costs.

This led the firm to end with a net loss of $2.2 million, an incremental improvement from the previous year’s net loss of $2.5 million. The quarterly bottom-line translates to a $0.03 loss per share.

As of June 30, 2023, the company’s total assets have grown to $10.5 million—a notable 64% increase from the ending balance in the previous fiscal year, which reported total assets of $6.4 million as of March 31, 2023.

The company also ended with a cash balance of $6.9 million vis-a-vis a starting balance of $2.7 million at the beginning of the period. The cash inflow is mainly driven by a $5-million non-brokered private placement the firm recently closed.

Operations-wise, the company secured new sales orders for 288 charging ports during the quarter, adding to a total of over 2,100 since starting operations in June 2021. During the same period, 316 charging ports were delivered, contributing to a total of over 1,050 since business commenced. Furthermore, the company expanded its sales backlog by 215 charging ports, with plans to begin phased deliveries of these chargers later in 2023.

In June, Hypercharge has entered an agreement with Precise ParkLink, a major parking solutions provider, that could substantially expand the EV charger provider’s footprint across Canada.

The arrangement entered with ParkLink entails in the co-selling and co-marketing of Hypercharge’s charging solutions to ParkLink’s network of over 1,000 clients. At the same time, the charging infrastructure will be integrated with ParkLink’s parking app, enabling consumers to be charged for their EV-charging directly within the app for a seamless experience.

Hypercharge last traded at $0.68 on the NEO.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.