The global oil market is about to face some very difficult times ahead. According to a latest forecast released by the International Energy Agency (IEA), the demand for oil is going to take significantly longer to recover than previously anticipated, and as more and more countries fail to get the coronavirus pandemic under control, additional long-lasting impacts will further contract the oil market.

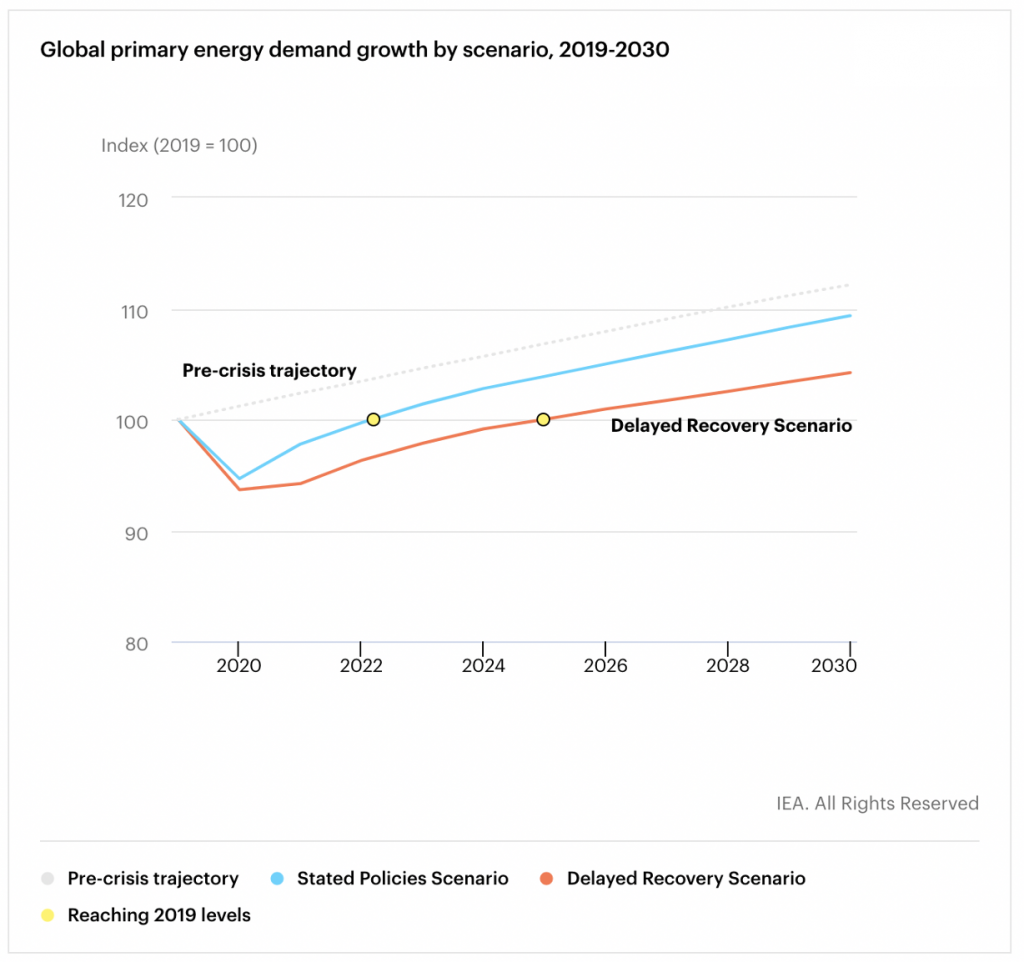

Since the beginning of the year, global oil consumption fell by an unparalleled 8%, as many countries around the world went into lockdown mode to mitigate the spread of the deadly virus. As a result, the IEA, in one of its more optimistic scenarios, predicts that demand for crude oil will not return to pre-pandemic levels until at least 2023 if COVID-19 is brought under control by next year.

If on the other hand the pandemic is prolonged and the global economy remains subdued for a longer period of time, then an oil recovery to pre-COVID-19 levels will not be seen until 2025 at the earliest. Even if either of the scenarios ensues however, the pandemic will still have a permanent negative impact on the oil market as per the forecast by the EIA.

Within the next decade, global oil demand growth will likely come to an end; the IEA reiterated its outlook on global oil demand plateauing by 2030, and then topping out at reduced levels thereafter. In fact, depending on the speed of the pandemic recovery and the resulting extent of economic damage, oil demand may only have several years left to grow.

Moreover, as an increasing number of consumers make the switch to more efficient and zero-emission modes of transportation, the demand for oil will be further subdued – even permanently. The IEA forecasts that consumption will rise by approximately 750,000 barrels per year until reaching 103.2 million per day by 2030 – which is nearly 2 million barrels per day less than predicted in last year’s report.

However, the anticipated increase in demand will be predominantly concentrated in developing countries such as India, as well as feedstocks for plastics and petrochemicals instead of transportation fuel. Then after 2030, the annual pace of growth will decline to a mere 100,000 barrels per day. If on the other hand, coronavirus outbreaks become more common and increase in severity, then the prolonged global economic recovery will cause oil consumption to remain below pre-pandemic levels until the latter half of the 2020s.

The IEA also noted that additional investments will need to be made into the oil industry in order to maintain its viability. Even after 2030, approximately $390 billion in investments are required each year to discover new crude supplies that are able to outweigh dwindling outputs from outdated oilfields.

Meanwhile, prices are expected to rise to US$75 per barrel by the latter end of the decade, which will once again encourage US drillers to begin spending again. Nonetheless, the US shale industry will still face unprecedented hurdles in terms of securing further investments due to its previous track record of debt reliance and lack of returns for investors.

Information for this briefing was found via the IEA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.