Inca One Gold Corp (TSXV: INCA) this morning provided a small update on its ongoing gold pre-payment facility. The facility, entered into with OCIM precious Metals SA, has enabled the company to significantly scale its operations as a result of the improved working capital position the facility provides.

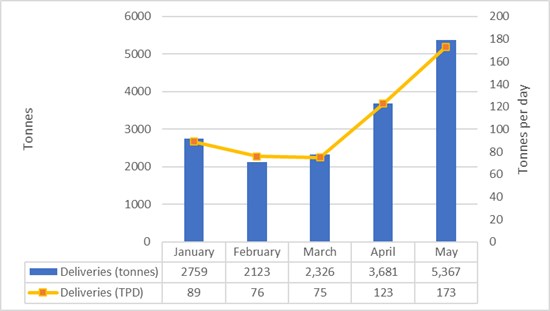

The facility itself amounts to US$2.5 million in dollar terms. Since the initial drawing of the facility in March 2021, significant progress has been made in terms of the increase in deliveries of tonnes of feedstock, while also enhancing gold production. Notably, May was a record month for production for the company, with a total of 5,367 tonnes processed and 2,219 gold ounces produced.

All funds from the facility have now reportedly been successfully deployed, with the first payment of gold under the facility made ahead of schedule. As a result of this, discussions are reportedly underway with the firm for a “significantly” larger and longer term gold pre-payment facility.

“We are pleased with the initial success of our OCIM gold pre-payment facility. It has allowed us to demonstrate that the supply of ore from our small-scale mining clients is sufficient to ramp up production to full capacity.”

Edward Kelly, CEO

Inca One Gold last traded at $0.35 on the TSX Venture.

FULL DISCLOSURE: Inca One Gold Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Inca One Gold Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.