The world’s leading copper producers are sounding the alarm about a looming shortage of mines to meet the growing demand for this essential metal amid the global transition to clean energy. This concern arises in the face of declining metal prices, which have been aggravated by a sluggish global economy and rising costs, prompting caution among executives, investors, and banks regarding new mining projects.

Additionally, labor shortages are impeding the production of new copper supplies, raising concerns about the transition to carbon-free power, as copper is crucial for manufacturing electric vehicles and upgrading electricity grids.

Kathleen Quirk, the president of Freeport-McMoran, the largest copper producer in the United States, emphasized that higher copper prices alone would not suffice to secure the necessary metal for the world’s green transformation. Speaking at the FT Mining Summit, she stated, “Now it’s not just about price. It’s these other factors that will genuinely limit the speed at which we can develop supplies. What may end up happening is that this energy transition gets extended out longer.”

Copper prices have declined by 4% this year, hovering around $8,000 per tonne, down from their peak of over $10,000 last year, mainly due to a cooling world economy and increased production in mines in Peru and Chile.

However, the demand for copper is expected to soar, driven by the green economy’s growth and the economic ascent of nations like India and other developing countries. Anglo American, one of the world’s largest mining companies, notes that the average Westerner’s living standards require 200-250 kilograms of copper per person, compared to a global average of 60 kilograms. Copper is utilized in a wide range of applications, from electrical wiring and household appliances to infrastructure like trains.

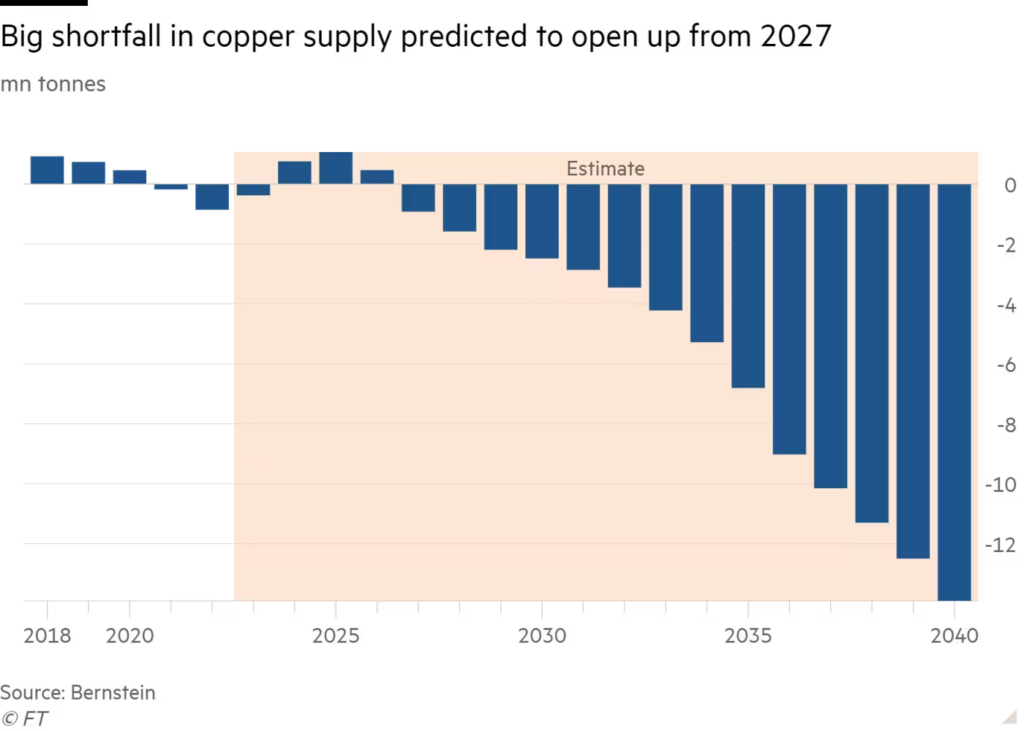

As the world embraces sustainable practices, copper’s role becomes increasingly critical, earning it the moniker “the metal of electrification.” S&P Global predicts that the market for copper will double to 50 million tonnes by 2035 compared to 2021 levels, with a “chronic gap” expected between supply and demand.

Speaking at the FT summit, Robert Friedland, a billionaire mining magnate and founder of Ivanhoe Mines, emphasized that the current dip in prices would exacerbate shortages in the future.

Despite the anticipated growth in demand, copper producers are struggling to initiate large projects because large, high-yield copper deposits are becoming scarce. For example, Freeport is exploring new technologies to extract copper from old mining waste piles ahead of expanding its mines.

Farid Dadashev, head of European metals and mining at RBC Capital Markets, pointed out that executives are reluctant to invest in mines that will take a decade or more to develop, with costs running into billions of dollars. This reluctance is exacerbated by low prices and political uncertainties in mining jurisdictions. He stated, “When you add further complexity from longer permitting timelines, higher inflation and generally declining ore body grades, this perhaps explains why we’re finding ourselves in the situation where it’s likely there won’t be enough copper to meet decarbonisation goals in the next few decades.”

Copper miners are increasingly acknowledging the likelihood of shortages in the latter part of this decade, which is driving innovation to substitute and reduce copper use in products. However, the extent to which such innovations can address the issue remains uncertain.

Maximo Pacheco, chair of Codelco, the Chilean state mining group, commented, “There will be some restructuring of demand.” Codelco produced the lowest volume of copper in 25 years in 2022.

According to a report by Chile’s Centre for Copper and Mining Studies, Codelco stands on the brink of insolvency due to escalating costs and a swelling debt burden.

For some, the scarcity of metals raises a dilemma between achieving economic decarbonization goals and the imperative to lift large portions of the world out of poverty, all without clear policy interventions. As Duncan Wanblad, chief executive of Anglo American, aptly put it, “Something has to give somewhere along the line.”

Information for this briefing was found via Financial Times and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.