After finally coming to the realization that it will take a lot more than just hopes and dreams to cool inflation, a freshly re-energized Jerome Powell entered the annual Jackson Hole summit with a stern message: the Fed will not let off on its hawkish monetary policy regardless of the economic pain caused by rising interest rates.

In a highly-anticipated speech, Powell delivered sobering news that the US economy is facing a difficult road ahead if inflation is to return to the central bank’s 2% target range, and at the expense of the robust labour market. “Reducing inflation is likely to require a sustained period of below-trend growth,” he said in a series of prepared remarks. “Moreover, there will very likely be some softening of labor market conditions.”

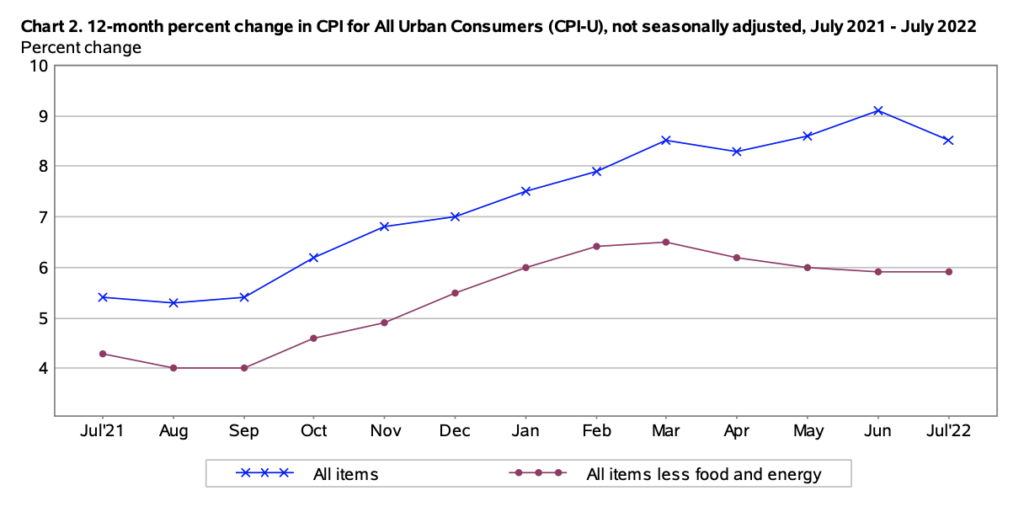

Latest CPI figures show an inflation rate that remains unchanged, suggesting the 40-year high price growth may finally be subsiding in wake of a temporary drop in commodity prices, the easing of supply chain bottlenecks, and a cooling housing market amid higher mortgage costs. “We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done,” said Powell. “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”

Powell warned that businesses and households will likely endure some financial pain in the name of restoring order in the US economy. Although that will come with substantial negative externalities, “failure to restore price stability would mean far greater pain.” His latest comments come on the heels of Wall Street’s expectations that the central bank may back off on raising rates further in light of weakening forthcoming economic data.

“While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down,” Powell added. However, the Fed Chair failed to indicate how many more rate hikes are en route for the US economy, or their magnitude.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.