K92 Mining (TSXV: KNT) this morning reported extensive assay results from its ongoing drilling at its Kainantu gold mine, located in Papua New Guinea. Results released include highlights of 10.4 metres of 24.81 grams per tonne gold, 11 grams per tonne silver, and 0.28% copper.

The drill results released come from a total of 37 diamond drill holes, all of which intersected mineralization. Drill holes were conducted both at surface and underground at the firms Kora deposit within the gold mine, demonstrating the continuing of the deposit.

Further, drilling discovered that there is another vein on site that contains mineralization, referred to as K3. This vein was not included in the original mineral resource established by K92 mining, and has demonstrated 2.84m of 5.36 grams per tonne gold, 628 grams per tonne silver, and 8.39% copper in a single drill hole – or 25.10 grams per tonne gold equivalent, over 1.68 metres true width.

Collectively, the results point to continuity of the Kora system at the gold mine, which has been “underpinned by multiple high grade intersections,” while remaining open in multiple directions. The Kora system will be a major focus for the firm in 2020 and 2021, with the focus being the expansion of the mineral resource. K92 currently plants to conduct a stage 3 expansions feasibility study.

K92 is currently in the process of expanding exploration on site, with the current count of six drill rigs to be expanded to nine by the end of the current quarter, and ten by the end of the year.

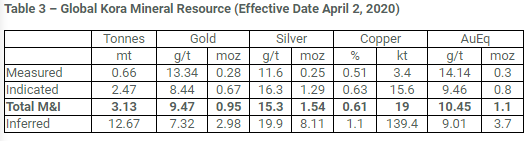

The Kora mineral resource at the mine currently contains gold equivalents of 10.45 grams per tonne with a 1.1 million ounce resource, in addition to inferred resources of 9.01 grams per tonne gold equivalent and a 3.7 million ounce resource.

Full drill results can be found in K92’s press release here.

K92 Mining last traded at $4.64 on the TSX Venture.

Information for this briefing was found via Sedar and K92 Mining. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.