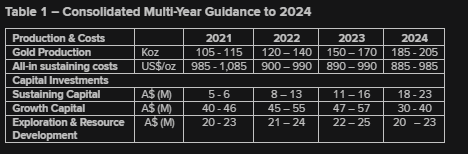

On June 28th, Karora Resources Inc. (TSX: KRR) announced its three-year production guidance, whereby they expect to double gold production by 2024. The company’s guidance expects the all-in sustaining costs to go from $985 – $1,085 in 2021, down to $885-$985 in 2024. This comes with them guiding that their production increases from 105,000 – 115,000 ounces in 2021 to 185,000 – 205,000 ounces by 2024.

Karora Resources currently has 8 analysts covering the company with an average weighted price target of C$6.31, or a 58.5% upside. Out of the eight analysts, one has a strong buy rating while the other seven have buy ratings. Red Cloud has the street high at C$9.00 while the lowest sits at C$5.50 from Cantor Fitzgerald.

Haywood Capital Markets reiterated their 12-month price target of C$6.00 and their buy rating off the back of this news. They say that this guidance demonstrates potential in the asset and has increased their NAV.

The production increase will be led by an expansion at the Beta Hunt underground mine, bringing production up to 2.0 Mtpa from 0.8. The ore will be processed by their own Higginsville mill, which is expected to process 2.5 Mtpa by 2024.

The company is confident that it will be able to meet the expansion expenses internally. The cost of the expansion will be in the range of A$162 million to A$198 million, while additional sustaining capital and exploration development will cost an estimated combined A$125 – A$153 million. They expect to pay for this via their $77 million in cash flow from operations.

Haywood believes that there is an upside to the Beta Hunt mine. They say that the Larkin Zone, “has the potential to increase grades above and beyond the current growth plan outlook.” They believe that the future by-product from the mine could be graded between 30c and 50c nickel trough discoveries which “provides further upside opportunity.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.